2020 has been quite a roller coaster ride for the stock markets. The recent positive developments regarding two COVID-19 vaccine candidates has been a drag on the work-from-home stocks but bodes well for many sectors that were crushed due to lower demand amid shelter-at-home mandates. Several medical device makers will likely gain from the success of COVID-19 vaccines as these companies have been seeing weak demand, as the world’s attention shifted from elective and other medical procedures to the unprecedented health crisis.

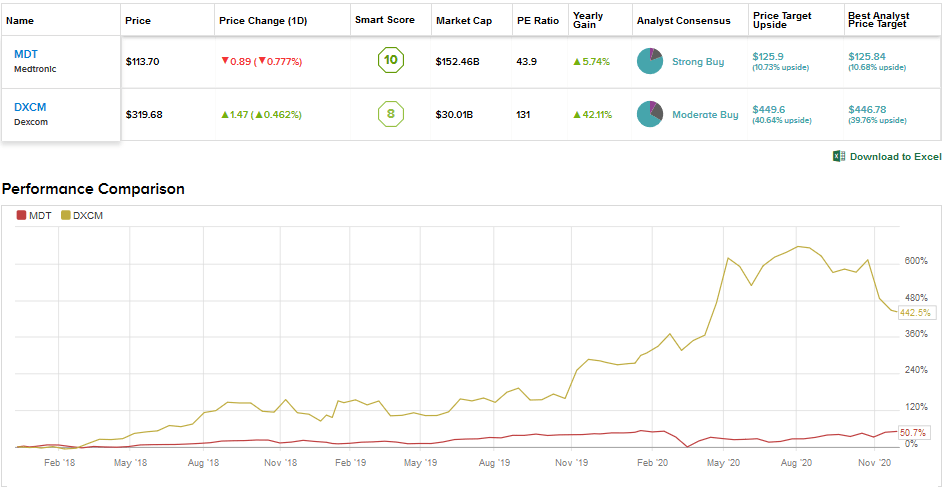

Amid rising hopes of a recovery, we will use the TipRanks Stock Comparison tool to stack up Medtronic against Dexcom and see which medical devices company offers a better investment opportunity.

Medtronic (MDT)

Leading medical device maker Medtronic boasts the Street’s support as several analysts are optimistic about its long-term growth prospects despite the pandemic weighing down sales in recent quarters.

The company has an impressive product pipeline and has won over 180 regulatory approvals in the US, Europe, Japan and China this year. These approvals include devices to treat cardiac complications, chronic pain, urinary incontinence, brain-related disorders and diabetes.

Medtronic is supplementing its organic growth with tuck-in acquisitions to strengthen its position in several areas like robotics. Its recent acquisitions include Ai Biomed to expand the ENT portfolio, Medicrea International and Digital Surgery to bolster the robotics portfolio and Avenu Medical to enhance its endovascular solutions. (See MDT stock analysis on TipRanks)

The company is also addressing its weakness in lucrative areas like diabetes. Its recently launched MiniMed 780G insulin pump is receiving a favorable response in Europe. Medtronic also commenced the limited release of the 770G insulin pump in the US in November. In September, the company acquired Companion Medical, the maker of InPen—a smart insulin pen system paired with an integrated diabetes management app.

Meanwhile, last week, Medtronic reported its 2Q FY21 (ended Oct. 30) results and stated that it was seeing “a faster-than-expected recovery and approaching year-over-year growth.” The company fared better-than-expected but 2Q organic revenue was still down 1.5% and adjusted EPS fell 22%.

Following the 2Q conference call, BTIG analyst Ryan Zimmerman increased the price target on Medtronic to $124 from $119 and reiterated a Buy rating. Zimmerman noted, “Near-term commentary on procedural trends was encouraging with weekly sales in November improving over October as mgmt. signaled that pre-earnings FY3Q21 Consensus estimates for MDT’s top-line were below guidance (-1% vs. flat to up slightly in FY3Q21).”

“Further, with mgmt. seeing no change to its expectations for FY4Q21, which assumes a normalization to sales, investors are likely assured that MDT should continue on its trajectory for the entire 2H of FY21. It seems that most investor focus though is looking past FY2H21 and onto FY22. As procedural dynamics stabilize and forthcoming pipeline products take hold, we believe the investments made in FY21 (which limited adj. OMs [operating margins]) should provide increased leverage through the P&L allowing adj. OM’s to get back to pre-COVID levels (~29%),” added the analyst.

Overall, a Strong Buy analyst consensus on Medtronic is backed by 17 Buys versus 3 Holds and 1 Sell. Shares are currently trading at the start of the year levels. The average price target of $125.90 reflects an upside potential of 10.7% in the months ahead.

Dexcom (DXCM)

Dexcom produces continuous glucose monitoring (or CGM) systems, which help diabetes patients track their blood glucose levels continually, unlike the traditional monitoring devices that reflect blood glucose levels at a particular point in time. While other medical device companies suffered over recent quarters due to COVID-led slowdowns, Dexcom delivered better-than-anticipated results thanks to higher sales of disposable sensors for its CGM systems.

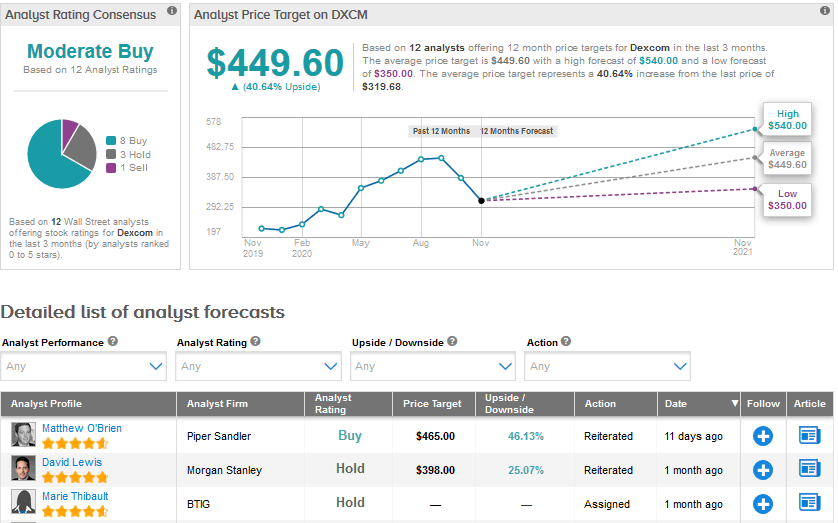

Despite strong volumes and new patient additions, Dexcom investors are concerned about pricing headwinds and rising competition. In October, shares took a hit when Wells Fargo analyst Larry Biegelsen downgraded the stock to Sell from Hold and slashed the price target to $350 from $420. Biegelsen feels that the recent approval of Abbott’s Libre 3 in Europe will put downward pressure on Dexcom’s pricing at a faster rate than anticipated by the Street as Libre 3 further closes the gap between the two companies’ CGM technology.

The analyst points out that Dexcom’s G6 CGM is currently priced at a 134% premium to Abbott’s Libre. He believes that with the growing adoption of the CGM category, customers around the world will become increasingly price-sensitive, thus putting pressure on Dexcom. (See DXCM stock analysis on TipRanks)

Meanwhile, Dexcom is positive about the demand for its products and recently raised its forecast to reflect full-year revenue growth of 29%. It is also gearing up to launch the G7 device (currently in clinical trials) in several key markets during the second half of 2021.

Dexcom sees tremendous international growth opportunities as diabetes is rising at an alarming rate. It has ramped up its manufacturing capacity to extend the G6 CGM offering to additional international markets, including recent launches in Belgium and Turkey.

Currently, the Street’s cautiously optimistic Moderate Buy analyst consensus for Dexcom is based on 8 Buys, 3 Holds and 1 Sell. Shares have gained 46.1% year-to-date and the average price target of $449.60 suggests further upside potential of 40.6% from current levels.

Conclusion

Medtronic is surely an attractive long-term play with a diverse product portfolio that focuses on 70 health conditions. Also, it pays a quarterly dividend of $0.57 and has a dividend yield of 2.05%. That said, Dexcom’s strong prospects in the diabetes market and the stock’s significant upside potential compared to Medtronic make it a more favorable pick currently, though its high valuation could be a deterrent for some investors.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment