McEwen Mining on Dec. 31 announced the highlights of a positive feasibility study (FS) for its Mexico Fenix project located in Sinaloa.

McEwen Mining (MUX), a gold and silver producer and explorer, said that the Fenix feasibility study predicted a 9.5-year mine life with an after-tax IRR (internal rate of return) of 28% using $1,500/oz gold and $17/oz silver. The project’s after-tax IRR almost doubled and the NPV (net present value) more than tripled compared to the base case at the current gold and silver price level.

IRR is the annual rate of growth an investment is expected to generate. NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

The average annual production forecast now stands at 26,000 oz gold in Phase 1 between years 1 to 6 involving a capital expenditure of $42 million. The average annual production forecast for Phase 2 is forecasted at 4,200,000 oz silver equivalent between years 7 and 9.5 involving capital expenditure of $24 million.

“The project will incorporate an environmentally progressive method of tailings management, using inpit storage that creates multiple benefits, most importantly a secure containment of tailings enabling better reclamation results,” McEwen Chairman Rob McEwen stated. “Our next steps will involve detailed engineering, assessment of procurement options, and the evaluation of financing alternatives.”

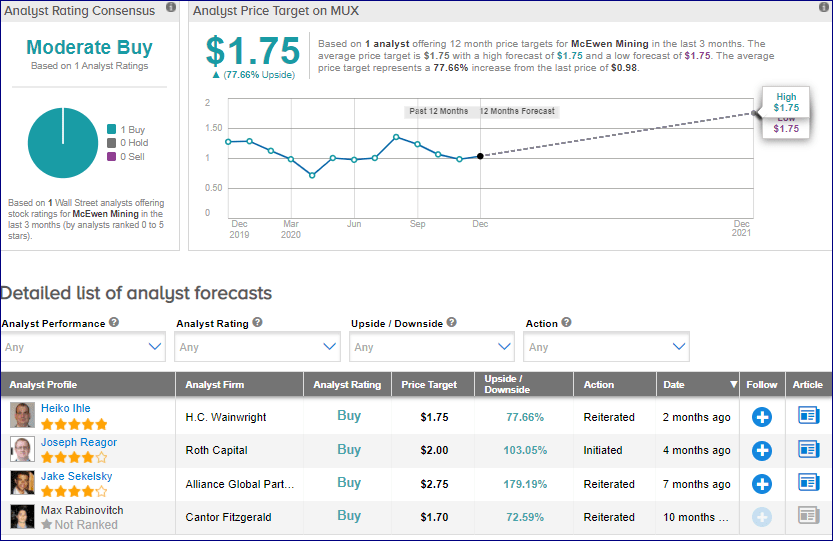

In reaction to the company’s 3Q20 financial results, PEA [Preliminary Economic Assessment] expected from Fox Complex and ongoing drilling success at Whiskey Jack, H.C. Wainwright analyst Heiko Ihle reiterated a Buy rating on the stock on Nov. 2.

However, Ihle lowered the price target to $1.75 (78% upside potential) from $2.50 due to adjusted financials, as well as various cost revisions across McEwen’s asset base. Shares have dropped 22.4% in 2020.

“During the quarter, the company recorded revenue of $27.4M amid a net loss of $9.8M, or ($0.02) per share. This compares to 3Q19 revenue of $32.7M and a net loss of $11.5M, or ($0.03) per share. The 16% YoY drop in revenue was based on the sale of 30,500 gold equivalent ounces (GEOs) in 3Q20, which declined by 36% YoY,” the analyst noted. (See MUX stock analysis on TipRanks)

“McEwen ultimately hopes to develop a plan for the Fox Complex and to reach an annual production rate of 100,000 – 150,000oz of gold at a cash cost of $800/oz, over a ten-year period,” he added. “McEwen commenced a new drill program at the Whiskey Jack target within Grey Fox. In short, the campaign continues to see success as visible gold occurred in eight of the 15 shallow holes drilled to-date.”

Related News:

U.K. Health Service Extends Window For Second Dose of Pfizer COVID-19 Vaccine

Thursday’s Market Snapshot: Here’s What You Need To Know Right Now

Generali Snaps Up Axa’s Greek Assets For €165M; Street Says Hold