Singapore-based solar panel manufacturer company, Maxeon Solar Technologies (NASDAQ: MAXN) slid in pre-market trading after the company’s losses widened in the third quarter. The company reported a third-quarter loss of $2.21 per share as compared to a loss of $1.09 per share in the same period last year. This loss was wider than analysts’ expectations of a loss of $0.90 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company posted revenues of $227.63 million in the third quarter, a decline of 17.4% year-over-year and below consensus estimates of $273.8 million.

In addition, the company announced the settlement of its dispute with SunPower Corp. (SPWR) and a new supply agreement. As a part of this new supply agreement, Maxeon will supply modules to SunPower until February of next year.

As a part of this deal, SunPower will have exclusive U.S. distribution rights for M-Series products until March 31 of next year. In return, Maxeon will be released from “non-circumvention obligations” for SunPower dealers. When a party is subjected to a “non-circumvention” clause in an agreement, the party is restrained from contacting the other party’s suppliers or dealers.

Maxeon will also receive warrants for SunPower stock, and all disputes on Master Supply Agreements stand resolved.

Looking forward, in the fourth quarter, the company expects to generate revenues in the range of $220 million to $260 million while adjusted gross loss is anticipated to be between $5 million and $15 million. Maxeon has projected Q4 shipments to be in the range of 610 Mega Watt (MW) to 650 MW.

Maxeon lowered its guidance for FY23 “to reflect the near term softening of residential demand, the recent SunPower settlement and the challenging market conditions which the Company expects to persist through the fourth quarter.”

In FY23, the company has projected revenues to be between $1.11 billion and $1.15 billion while adjusted EBITDA is likely to be within a range of $4 million to $14 million.

Is MAXN a Good Stock to Buy?

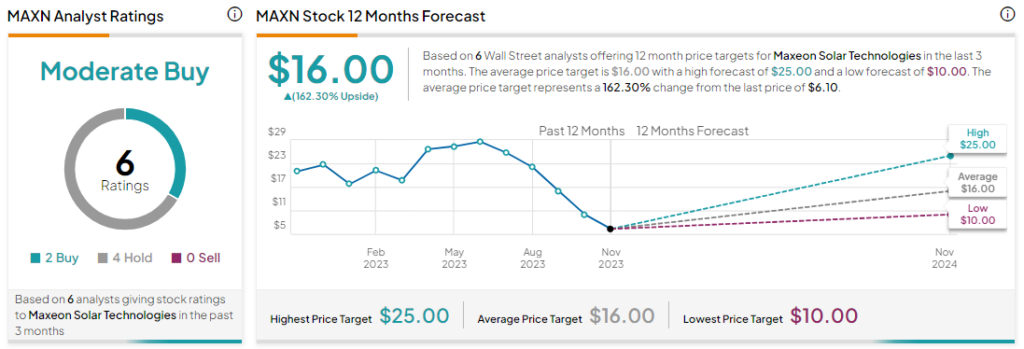

Analysts are cautiously optimistic about MAXN stock with a Moderate Buy consensus rating based on two Buys and four Holds. MAXN stock has slid by more than 60% year-to-date while the average MAXN price target of $16 implies an upside potential of 162.3% at current levels.