Maxeon Solar Technologies, Ltd. (MAXN) reported a loss in the first quarter. The company designs, manufactures and sells advanced SunPower-branded solar panels to customers. Shares of the company fell almost 10% on May 21.

The company incurred a loss of $1.14 per share in Q1, compared to the $1.48 loss per share estimated by analysts. A loss of $1.49 per share was reported in the same quarter last year.

Revenue generated in the quarter was $165.4 million, representing a decline of 27.3% from the year-ago period. However, the figure was above the consensus estimate of $160.3 million.

Maxeon Solar Technologies CEO Jeff Waters said, “We are optimistic about our long-term prospects as we continue to make significant progress in key strategic growth areas. Our newly announced initiative to bring Performance line products to North America is progressing rapidly, with an agreement to supply approximately 1 GW for Primergy’s Gemini Project.” (See Maxeon Solar Technologies stock analysis on TipRanks)

For the second quarter, the company expects revenues to be in the range of $165-185 million. The consensus estimate is pegged at $218.7 million.

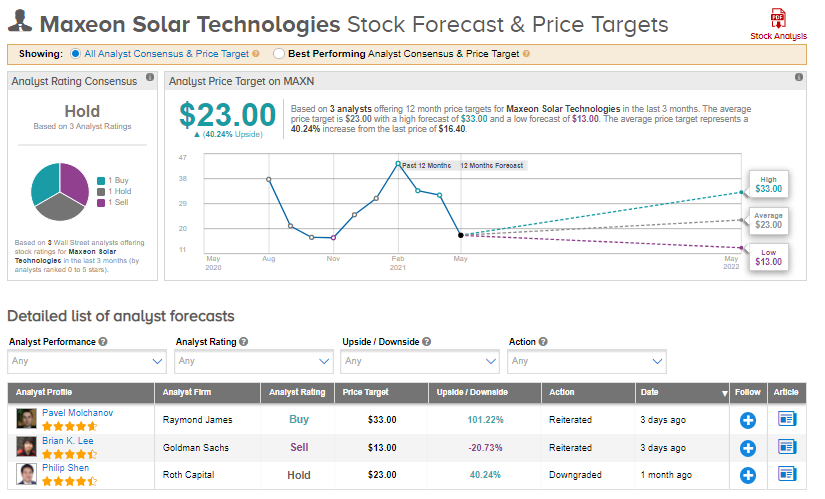

Following the earnings announcement, Raymond James analyst Pavel Molchanov reiterated a Buy rating on Maxeon Solar Technologies with a price target of $33 (101.2% upside potential).

Molchanov commented, “We favor the company’s above-average exposure to the European market, bolstered by the European Climate Law; as well as its joint venture participation in China, whose world-leading PV newbuilds are boosting domestic module pricing.”

Overall, the stock has a Hold consensus rating based on 1 Buy, 1 Hold, and 1 Sell. The average analyst price target of $23 implies almost 40.2% upside potential from current levels. Shares have decreased 56.4% over the past year.

Related News :

Ashland Bumps up Quarterly Dividend By 9%

Home Depot to Buy Back $20B in Stock; Street Says Buy

Criteo Enhances Retail Media Business with Mabaya Buyout