Toy manufacturer Mattel, Inc. (NASDAQ: MAT) has reported outstanding results for the first quarter of 2022. Adjusted earnings came in at $0.08 per share, compared with the year-ago loss of $0.10 per share and the Street’s loss estimate of $0.04 per share.

Net sales grew 19% year-over-year to $1.04 billion, exceeding analysts’ expectations of $917.95 million. Net sales in the North America segment increased 26%, and the International segment’s net sales rose 16% during the quarter.

Management Comments

Ynon Kreiz, the Chairman and CEO of Mattel, said, “Mattel achieved its highest first-quarter results we have on record for net sales, operating income, and EBITDA. Our strong performance continued, with growth across regions, categories, and our three power brands. These results are in line with our strategy to grow Mattel’s IP-driven toy business.”

“The full-year outlook is strong, we expect to grow market share, and we are reiterating our 2022 guidance and 2023 goals,” Kreiz added.

Mattel’s CFO Anthony DiSilvestro said, “Our topline performance benefited from increased points of distribution, as well as retailers restocking low inventories following the strong holiday season and gearing up to support product launches tied to the upcoming theatrical releases. Looking ahead, we continue to expect to grow net sales in 2022 by 8-10% in constant currency, driven by growth in our leader categories, led by our power brands and American Girl, as well as our Challenger categories.”

Guidance

For 2022, the company anticipates net sales to grow in the range of 8%-10% and adjusted EPS between $1.42 and $1.48. The Street expects net sales and adjusted EPS to total $5.83 billion and $1.45, respectively.

Further, Mattel projects adjusted EPS to be more than $1.90 and net sales to rise in the high single-digit percentage range in 2023 versus the consensus estimate of $1.85 and $6.27 billion, respectively.

About Mattel

Mattel designs, manufactures and sells toys. Its most popular brands include Barbie, Hot Wheels, Fisher-Price, American Girl, UNO, Mega, Thomas & Friends, Polly Pocket, Masters of the Universe, Monster High and Enchantimals.

Price Target

Based on seven Buys and three Holds, Mattel has a Moderate Buy consensus rating. MAT’s average price target of $32.15 implies 31.3% upside potential from current levels. Shares have gained 17.2% over the past three months.

Website Traffic

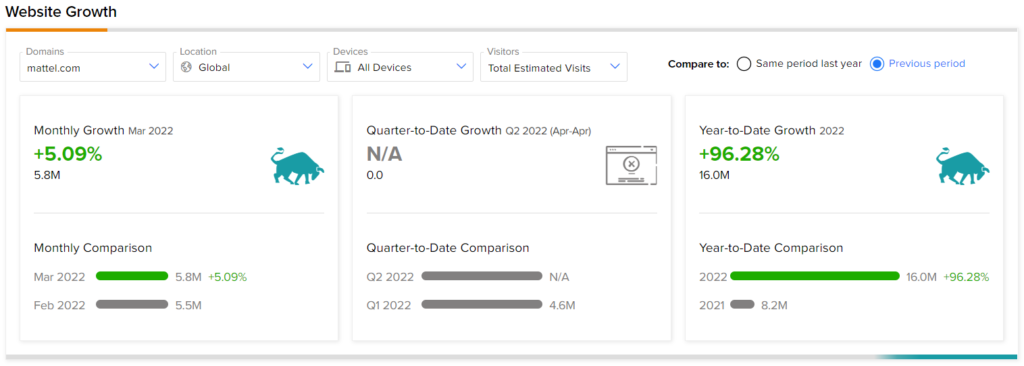

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Mattel’s first-quarter performance.

According to the tool, Mattel’s website traffic registered a 5.1% rise in global visits in March compared to February. Moreover, the website traffic has increased 96.3% year-to-date against the same period last year.

The uptrend in the company’s website visits supports the year-over-year rise in its sales and earnings. This shows that TipRanks’ website traffic tool helps in making reliable predictions about a company’s results.

Conclusion

Following the release of the first-quarter results, after the market closed on Wednesday, MAT stock gained 3.3% to end the day at $25.30. The stock had gained 10.8% during the day trade as the news of the company considering a potential sale spread.

Mattel is in early-stage talks with equity firms Apollo Global Management Inc. (NYSE: APO) and L Catterton to sell itself. Strong first-quarter results are likely to help the California-based company bag a better deal.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Read full Disclaimer & Disclosure

Related News:

Why is Mattel Stock Rising?

Despite Q1 Beat, Why Did Texas Instruments Shares Tumble?

Thoughtworks Expands to Vietnam; Street Sees 43% Upside