Mattel (NASDAQ: MAT) shares jumped over 12% during the extended trading session on February 9, after the company delivered a blowout fourth-quarter results and also provided FY2022 guidance well above the analysts’ expectations.

To add to investors’ cheer, the company raised its long-term sales growth outlook for FY2023.

Q4 Beat

Adjusted earnings of $0.53 per share significantly beat analysts’ expectations of $0.30 per share. The company reported earnings of $0.40 per share for the prior-year period.

Revenues jumped 10% year-over-year to $1.8 billion and exceeded consensus estimates of $1.65 billion. The increase in revenues reflected a surge in the North American segment, which increased 14% as well as growth in the International segment of 9%.

2022 and 2023 Outlook

Based on robust Q4 results, management issued the financial guidance for FY2022 as well as FY2023.

The company forecasts adjusted earnings in the range of $1.42 to $1.48 per share, while the consensus estimate is pegged at $1.39 per share. Net sales are forecast to grow 8% to 10% year-over-year.

Encouragingly, for FY2023, adjusted earnings are likely to be higher than $1.90 per share. Net Sales are projected to grow in the high-single-digits, higher than the prior outlook of mid-single-digit growth).

CEO Comments

Mattel CEO, Ynon Kreiz, commented, “We have made significant progress on our transformation strategy over the last few years, and our turnaround is now complete.”

Looking ahead, he added, “We are in growth mode and believe we are well-positioned to continue our momentum, with 2022 guidance exceeding prior goals and an even stronger outlook for 2023.”

Wall Street’s Take

Following the upbeat Q4 results, Truist Securities analyst Michael Swartz increased the price target on the stock to $26 from $24 and reiterated a Hold rating.

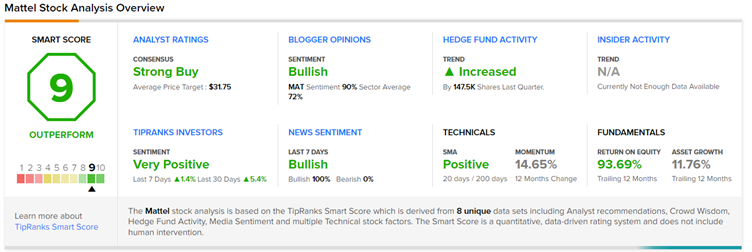

Overall, the stock has a Strong Buy consensus rating based on 4 Buys and 2 Holds. The average Mattel price target of $30.6 implies 34.51% upside potential from current levels.

TipRanks’ Smart Score

Mattel scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Warner Music Delivers Upbeat Q1 Results; Shares Drop 6.9%

Yum China Holdings Drops 4% on Lacklustre Results

Liberty Oilfield Services Tanks 6.5% on Wider-Than-Expected Q4 Loss