Shares of Marvell Technology plunged 6% in Thursday’s extended trading after the semiconductor company provided a lower-than-expected 4Q revenue outlook and said that supply constraints are preventing it from meeting demand.

Marvell (MRVL) forecasts 4Q revenues of $785 million (+/- 5%), which is slightly lower than Street estimates of $786.2 million. Nonetheless, the mid-point of its non-GAAP earnings guidance range, $0.25-$0.33, came in above analysts’ projection of $0.28.

Matt Murphy, Marvell’s CEO, said, “Demand continues to increase, and we are guiding fourth fiscal quarter revenue at the mid-point to grow approximately 5% sequentially. Our team is working to mitigate the impact of industry-wide supply constraints that are currently limiting our ability to fully satisfy the increase in demand.” (See MRVL stock analysis on TipRanks)

Meanwhile, Marvell’s 3Q adjusted EPS jumped 47% to $0.25 year-on-year and matched the Wall Street forecast. Its revenues of $750.1 million marked a 13% year-over-year improvement, but came in slightly lower than the consensus estimate of $750.4 million.

Murphy said, “Marvell continued to deliver strong revenue growth in the third fiscal quarter. Overall revenue increased 13% year on year, driven by our networking business, which grew revenue 35% year on year. Strong 5G and Cloud product ramps are fueling our ongoing success in these strategic growth markets.”

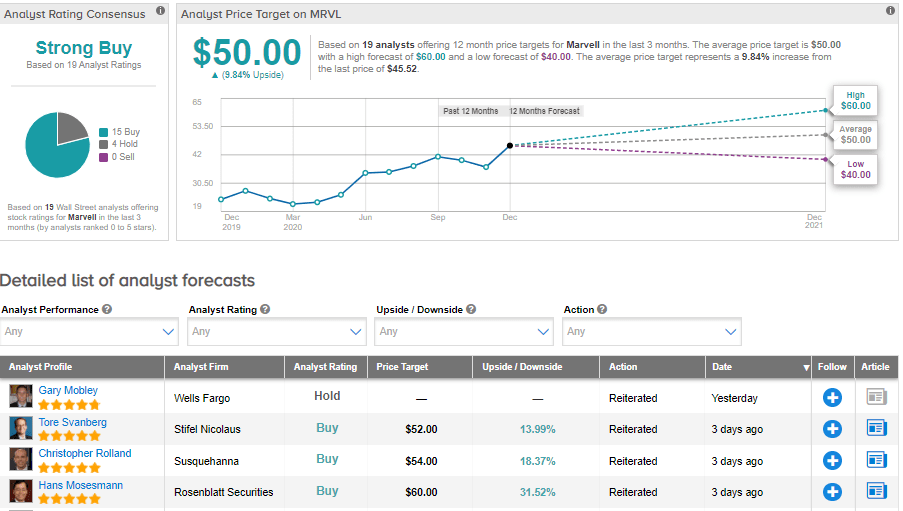

Ahead of its earnings release, on Dec. 1, Rosenblatt Securities analyst Hans Mosesmann reiterated a Buy rating and the price target of $60 (31.8% upside potential). In a note to investors, Mosesmann wrote, “We expect sales and non-GAAP EPS to be in-line or slightly above management’s guidance of $750 million (+3.1% q/q) and $0.25, respectively. We see the quarter being driven by strength in Networking, Cloud, and 5G sales and flat Storage sales (stronger SSD (solid state drive) controllers offset by weaker enterprise).”

Like Mosesmann, most of the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 15 Buys and 4 Holds. The average price target stands at $50 and implies upside potential of about 9.8% to current levels. Shares have gained 71.4% year-to-date.

Related News:

Okta Jumps 9% As Cloud Demand Boosts Sales; Analyst Lifts PT

Elastic Pops 9% On Lower-Than-Feared 2Q Loss; Street Sticks To Buy

CrowdStrike Surges 14% On Stellar Outlook; Analyst Boosts PT