The ongoing saga of the sale of soccer team Manchester United (NYSE:MANU) may finally be coming to a close. A preferred bidder has emerged, and the “deal timeline” seems to be running on schedule. That was enough to send shares of Manchester United up over 7% in Tuesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The new top bidder is none other than Qatar’s Sheikh Jassim, who stepped ahead of Sir Jim Radcliffe to take the top spot. This is after the third—and as noted by Football 365, final—round of bidding on the team. Now, within the next several weeks, the current owners—the Glazer family—will pick their bidder of choice to sell the team off to. The decision comes down to how much control the Glazers want to have in the future; a sale to Jassim will require the Glazers to depart altogether, while Radcliffe’s offer is for just 50% of the team, leaving the Glazers as 20% owners.

The deal would be one of the most valuable in soccer’s history and, indeed, in much of sporting history. Express notes that this deal would be far and away larger than the 4.8 billion pounds involved in the sale of the Washington Commanders. However, the Express report also notes that Jassim’s bid fell short of the Glazers’ valuation, and Radcliffe’s offer of a controlling interest buy may be closer to what the Glazers were looking for.

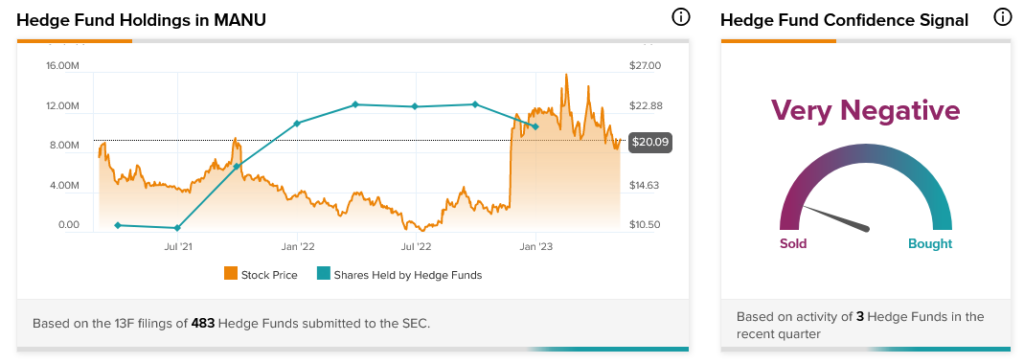

Hedge funds have been increasingly looking to bail out of Manchester United stock. In fact, hedge funds’ perception of Manchester United stock turned “Very Negative” after selling off 2.3 million shares in the previous quarter.