Snap (SNAP) is a social media company that operates the photo-sharing app Snapchat. Its primary source of revenue is advertising. It also sells hardware products under the Spectacles brand.

For Q4 2021, Snap reported a 42% year-over-year rise in revenue to $1.3 billion, surpassing the consensus estimate of $1.2 billion. It posted adjusted EPS of $0.22, which rose from $0.09 in the same quarter the previous year and beat the consensus estimate of $0.10.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Snap.

Risk Factors

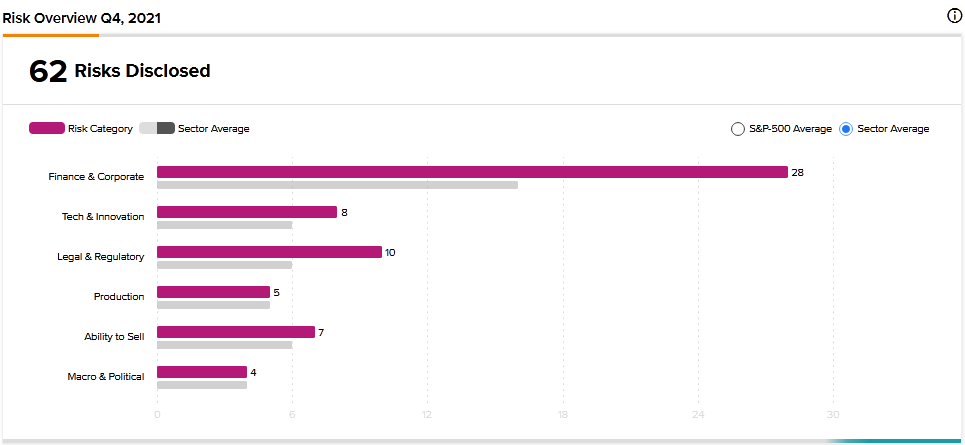

According to the new TipRanks Risk Factors tool, Snap’s top risk category is Finance and Corporate, which contains 28 of the total 62 risks identified for the stock. Legal and Regulatory and Tech and Innovation are the next two major risk categories with 10 and 8 risks, respectively. Snap has recently added one new risk factor and updated several previously highlighted risks.

In the newly added risk factor, which falls under the Legal and Regulatory category, Snap informs investors that some of its products require regulatory approvals before they can be launched. It specifically mentions Spectacles glasses, which it says is subject to FDA oversight as a medical device. Snap goes on to explain that its future products may also be subject to FDA regulations as medical products. The problem is that obtaining marketing clearance for a regulated product can be costly and time-consuming.

In an updated risk factor, Snap reminds investors that it has outstanding debts that it needs to service while also funding its business operations. It explains that its ability to service the debts and continue to invest in the business depends on many factors outside its control.

As a result, the company cautions that it may not generate sufficient cash flow to meet its debt obligations and investment requirements. Therefore, Snap may default on its debts, and the remedial measures it takes may not be successful, which could cause a serious blow to the business.

In another updated risk factor, Snap reminds investors of the uncertainties in its strategic acquisitions and investments. The company explains that its business strategy involves making strategic acquisitions to add specialized talent and complementary technologies. It also invests in public and private companies to advance its strategic objectives.

The problem is that the acquisitions and investments may not produce the expected benefits. Snap may need to sell more shares or borrow to fund the acquisitions and investments. Consequently, such financing moves may dilute existing shareholders’ holdings and increase the company’s debt burden. Furthermore, Snap cautions that the White House and Congress have proposed measures that could make it more difficult for companies to complete acquisitions.

Analysts’ Take

Piper Sandler analyst Thomas Champion recently reiterated a Buy rating on Snap stock but lowered the price target to $53 from $72. Champion’s reduced price target still suggests 39.92% upside potential. The analyst notes that Apple’s privacy changes remain a near-term headwind for companies like Snap.

Consensus among analysts is a Moderate Buy based on 18 Buys and 9 Holds. The average Snap price target of $55.20 implies 45.72% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Meta Threatens to Remove FB and Insta from EU Amid Privacy Issues

Tenet Healthcare Posts Mixed Q4 Results

Understanding Bill.com’s Risk Factors