PayPal (PYPL) is a global digital payments provider that was previously a subsidiary of e-commerce platform eBay (EBAY). It’s a component of the S&P 500, having first been added to the index in 2015. In addition to its namesake brand, PayPal’s other brands include Venmo, Xoom, and Zettle.

For Q4 2021, PayPal reported a 13% year-over-year jump in revenue to $6.9 billion, modestly surpassing the consensus estimate of $6.86 billion. It posted adjusted EPS of $1.11, which rose from $1.08 in the same quarter the previous year but missed the consensus estimate of $1.12.

With this in mind, we used TipRanks to take a look at the newly added risk factors for PayPal.

Risk Factors

According to the new TipRanks Risk Factors tool, PayPal’s top risk category is Legal and Regulatory, which contains 8 of the total 29 risks identified for the stock. Ability to Sell, Tech and Innovation, and Macro and Political are the next three major risk categories, each with 5 risks. PayPal has recently added two new risk factors to its profile.

The company tells investors that it measures and reports key metrics on the activity on its platform. It explains that it regularly reviews its processes for calculating the metrics to improve their accuracy. However, PayPal cautions that if investors, customers, or analysts were to question the accuracy of its reported performance measures, its reputation may be damaged and its business may be adversely impacted.

PayPal informs investors in another newly added risk factor that customers, investors, and employees are increasingly focused on companies’ environmental, social, and governance (ESG) practices. It cautions that if it does not meet ESG expectations, some customers may stop using its products, its financial condition may be adversely impacted, and the company’s reputation may be damaged.

Furthermore, PayPal explains that its headquarters are located in California, which has experienced extreme weather conditions. It mentions that drought, water scarcity, and wildfires have become more frequent in California and may continue to disrupt its operations. Moreover, the company cautions that climate change-related challenges may cause it to incur additional costs related to the resumption of operations after a disruption and meeting tightening regulatory requirements.

Analysts’ Take

Following PayPal’s Q4 earnings report, Bernstein analyst Harshita Rawat reiterated a Hold rating on PayPal stock but lowered the price target to $140 from $180. Rawat’s reduced price target still suggests 11.04% upside potential.

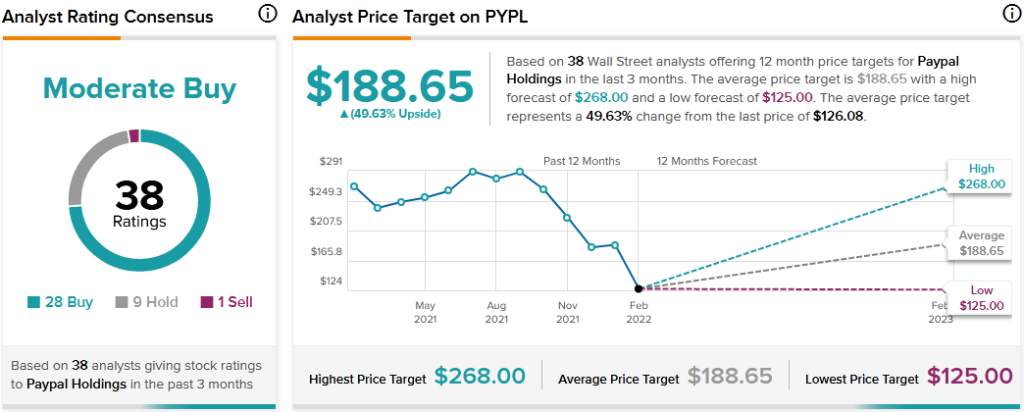

Consensus among analysts is a Moderate Buy based on 28 Buys, 9 Holds, and 1 Sell. The average PayPal price target of $188.65 implies 49.63% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Meta Platforms Reveals Metaverse Uncertainties in Newly Added Risk Factor

Royal Caribbean’s Sail to Profitability Delayed; Shares Plunge 4.8%

Apple to Unveil New Low-Cost 5G iPhone and iPad in March