New York-based Golub Capital (GBDC) engages in the business of investment. It primarily invests in senior secured and one-stop loans.

For Fiscal Q4 2021 ended September 30, Golub reported adjusted EPS of $0.42, which beat the consensus estimate of $0.30. The company recently distributed a quarterly dividend of $0.30 per share. Golub stock currently offers a dividend yield of 7.56%, compared to the sector average of 1.68%.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Golub Capital.

Risk Factors

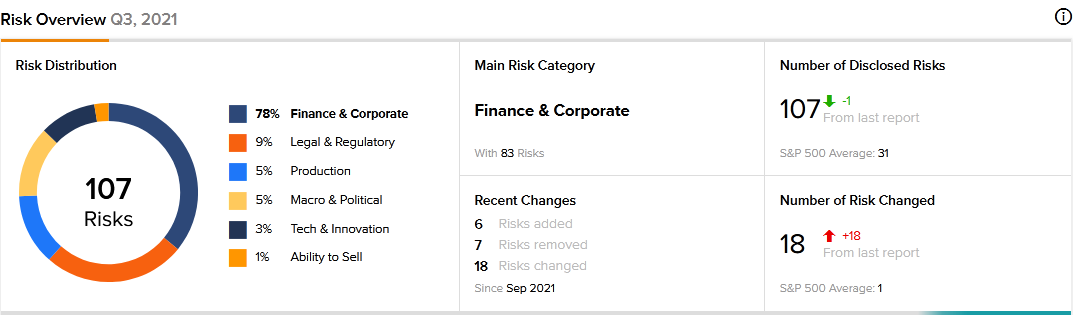

According to the new TipRanks Risk Factors tool, Golub Capital’s main risk category is Finance and Corporate, representing 78% of the total 107 risks identified for the stock. Legal and Regulatory and Production are the next two major risk categories at 9% and 5% of the total risks, respectively. Golub Capital recently updated its profile with six new risk factors.

The company cautions that if it decides to pay a portion of its dividend in shares, shareholders may be exposed to adverse tax consequences.

Golub Capital informs investors that it has not placed a limit on the amount of funds from sources like borrowings and proceeds from securities offerings that it can distribute to shareholders. The company explains that the lack of a limit could reduce the amount of capital it has available to invest.

Golub Capital primarily invests in private companies. It explains that since private companies have limited access to the capital markets, their ability to withstand financial distress is reduced. Moreover, Golub Capital says that private companies tend to have less experienced management compared to public companies. It cautions that the decisions made by such management teams or the exit of key personnel could have a significant adverse impact on Golub Capital’s returns from investments.

The company informs investors that technological innovations continue to disrupt industries and markets across the board. Golub Capital warns that such disruptions could change the market practices it has been used to and increase competition for its portfolio companies. As result, its business, investment results, and financial condition could be adversely affected.

The Finance and Corporate risk factor’s sector average is 59%, compared to Golub Capital’s 78%. Golub Capital’s stock gained about 9 percent in the past year.

Analysts’ Take

In December, Wells Fargo analyst Finian O’Shea maintained a Buy rating on Golub Capital but lowered the price target to $16.75 from $17.50.

Consensus among analysts is a Moderate Buy based on 1 Buy. The average Golub Capital price target of $16.80 implies 8.81% upside potential to current levels.

Download the mobile app now, available on iOS and Android.

Related Links:

Tencent Taking Minority Stake in U.K. Digital Bank Monzo – Report

Nancy Pelosi Buys Google, Disney, Roblox & Other Tech Stocks

Tesla Smashes Vehicle Delivery Expectations