California-based Electronic Arts (EA) makes video games accessible on consoles, smartphones, and personal computers. Its titles include Need for Speed, Apex Legends, Battlefield, and EA SPORTS FIFA.

Reported revenue of $1.79 billion for Fiscal Q3 2022 ended December 31 rose from $1.67 billion in the same quarter the previous year. However, EPS of $0.23 declined from $0.72 in the prior-year quarter.

Electronic Arts plans to distribute a quarterly cash dividend of $0.17 per share on March 23 and has set March 8 as the ex-dividend date.

With this in mind, we used TipRanks to take a look at the added risk factors for Electronic Arts.

Risk Factors

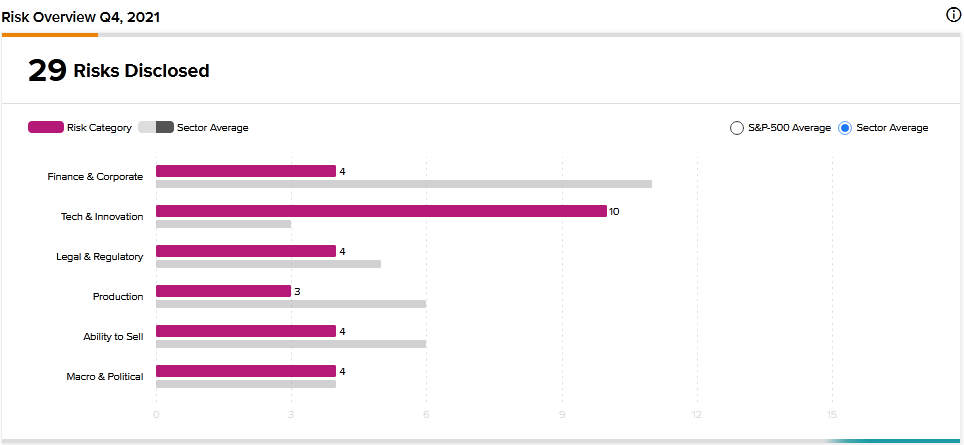

According to the new TipRanks Risk Factors tool, Electronic Arts’ main risk category is Tech and Innovation, which contains 10 of the total 29 risks identified for the stock. Finance and Corporate and Legal and Regulatory are the next two major risk categories, each with 4 risks. The company has recently added one new risk factor and updated several previously highlighted risks.

In the newly added risk factor, which falls under the Production category, Electronic Arts informs investors of the challenging labor environment in which it operates. It explains that its business depends on its ability to attract and retain skilled personnel for management, product development, and marketing roles. The problem is that the market for highly-skilled workers in Electronic Arts’ sector is extremely competitive. Furthermore, the company has become a prime target for talent poaching, given its market leadership.

Electronic Arts cautions that although it strives to provide a great workplace environment for its teams, it may still struggle to recruit and retain qualified workers. If it is unable to maintain the right talent, the company warns that it may find it difficult to develop and manage its business. Moreover, its reputation may be damaged.

In an updated risk factor, Electronic Arts reminds investors of the challenges to meet the expectations of its customers, fans, and regulatory authorities. For example, it says some of its games allow players to purchase digital items. This feature has attracted the attention of the Electronic Arts community and could generate a negative perception around gameplay fairness.

The company cautions that an adverse perception of its in-game purchase feature could damage its reputation. Such adverse reactions could also cause the company to delay the release of new products, which could result in revenue loss. Furthermore, Electronic Arts tells investors that the content generated by its community may contain objectionable materials, which could, in turn, expose the company to regulatory actions and lawsuits.

Electronic Arts stock has declined about 3.4% over the past 12 months.

Analysts’ Take

Barclays analyst Mario Lu recently maintained a Hold rating on Electronic Arts stock but lowered the price target to $127 from $152. Lu’s new price target suggests 6.47% downside potential.

Consensus among analysts is a Strong Buy based on 14 Buys and 3 Holds. The average Electronic Arts price target of $162.06 implies 19.35% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

EQT Posts Disappointing Q4 Results; Shares Drop 3%

XPeng Gains 9.6% on Inclusion in the Shenzhen-Hong Kong Stock Connect Program

MGM Beats Q4 Expectations; Shares Up 5%