Chipotle Mexican Grill (CMG) is a fast-food restaurant chain operating in the U.S., Canada, the U.K., Germany, and France. At the end of 2021, the S&P 500 company operated more than 2,950 restaurants across its markets.

Chipotle’s revenue jumped 22% year-over-year to $2 billion in Q4 2021, surpassing the consensus estimate of $1.95 billion. It posted adjusted EPS of $5.58, which rose from $3.48 in the same quarter the previous year and beat the consensus estimate of $5.29.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Chipotle.

Risk Factors

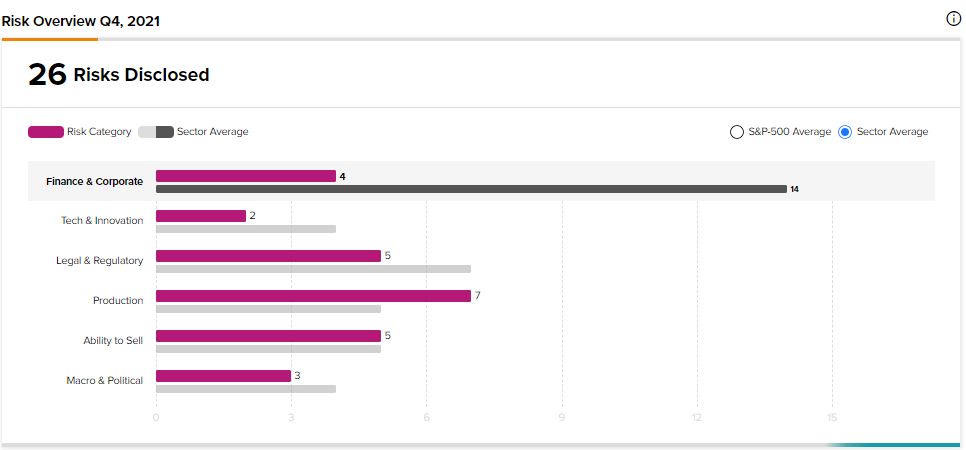

According to the new TipRanks Risk Factors tool, Chipotle’s top risk category is Production, which contains 7 of the total 26 risks identified for the stock. Legal and Regulatory and Ability to Sell are the next two major risk categories, each with 5 risks. Chipotle has recently updated its profile with three new risk factors.

In a newly added Production risk factor, Chipotle informs investors of the labor challenges it faces. It explains that its labor costs are increasing, mentioning regulations around minimum wages, expenses related to the COVID-19 pandemic, and a competitive job market as the contributing factors.

It says that it may need to raise menu prices to offset higher labor costs, but the success of that strategy would depend on customers’ willingness to pay higher prices for its meals. Chipotle cautions that if it is unable to hike menu prices because of competition or other factors, its profitability may decline.

Regarding its labor issues, the company says that there have been efforts to get its employees into labor unions. It cautions that if a significant number of its workers choose to unionize, its labor costs could increase. Moreover, a unionized workforce could have an adverse impact on Chipotle’s culture, reduce its flexibility, and disrupt the business. The company further cautions that its reaction to the unionization of its workforce could adversely impact its reputation and drive customers away.

In a newly added Ability to Sell risk factor, Chipotle cautions that its delivery business could run into trouble for various reasons. It first explains that more than 45% of its total revenue in 2021 was generated through digital orders. This involved customers ordering meals through an app to pick up at the restaurant or have the order delivered to them. Delivery orders contributed more than 21% of the company’s total revenue in 2021.

For deliveries, Chipotle relies on third-party services. The problem is that the actual delivery costs the restaurant ends up paying to the third parties may exceed the delivery fees charged to customers, hence reducing Chipotle’s profitability. The company further cautions that if a delivery provider fails to ship its orders in a timely manner, disappointed customers may attribute the bad experience to Chipotle and could stop buying from the company.

Analysts’ Take

Kalinowski analyst Mark Kalinowski recently upgraded Chipotle stock to a Buy from a Hold. The analyst has a price target of $1,900 on the stock, which suggests 21.25% upside potential.

Consensus among analysts is a Strong Buy based on 17 Buys and 4 Holds. The average Chipotle price target of $1,945.19 implies 24.14% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Marriott International Q4 EPS Grows Over 10x; Shares Up 5.8%

IBM Acquires Neudesic for Undisclosed Amount

Airbnb Jumps 7% on Exceeding Q4 Expectations