Magnachip Semiconductor Corporation (MX) confirmed the receipt of a hostile bid from Cornucopia Investment Partners, a private investment firm, to buy all of the outstanding shares of MX for cash. Shares jumped 12.4% to close at $25.91 on June 11.

The cash consideration is calculated at $35 per share and is based on the company’s disclosure of 47,470,416 fully diluted common shares in its Form 10-Q filed on May 10.

Magnachip engages in the design and manufacture of analog and mixed-signal semiconductor products. (See Magnachip stock analysis on TipRanks)

On March 25, the company inked a deal to merge with South Dearborn Limited, an investment vehicle established by Wise Road Capital LTD (Wise Road). The all-cash deal was valued at $1.4 billion, wherein MX would receive $29 per share in cash for all of its outstanding shares, implying a 54% premium to the unaffected closing price of March 2.

Following the bid from Cornucopia, the company’s Board expects to postpone the special shareholders meeting which was to be held at 8:00 pm ET on June 15, 2021, to June 17, 2021.

The bid submitted by Cornucopia is higher than the previously agreed deal with Wise Road, and the Board is yet to determine whether the new bid is superior to the earlier one, and retains its right to accept the merger agreement with Wise Road Capital.

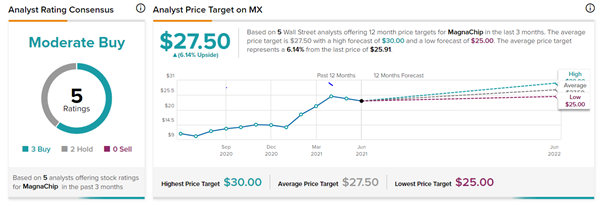

Needham analyst Rajvindra Gill recently assigned a Buy rating to the stock with a price target of $30, implying 15.8% upside potential to current levels.

Gill said, “We remain bullish on MX and believe it will benefit from increased OLED penetration stemming from 5G and foldable phones and increased demand for premium Power products, particularly in the high-growth EV market. We believe a fabless business focusing exclusively on OLED and Power will result in a higher blended gross margin in the 30% range (even on a lower revenue base) and warrant a higher P/E multiple over time.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 3 Buys and 2 Holds. The MX average analyst price target of $27.50 implies 6.1% upside potential to current levels. Shares have gained 92.8% over the past year.

Related News:

KKR Acquires Aviation Loan Portfolio from CIT Group, Launches AV AirFinance

Omnicom Divests ICON International; Shares Rise

Chewy Reports Better-Than-Expected Q1 Results; Shares Slip