Department store chain Kohl’s Corp. (NYSE: KSS) has reported weak results for the fiscal first quarter ended April 30. Adjusted earnings declined 90% year-over-year to $0.11 per share, missing the Street’s estimate of $0.69 per share.

Total revenue fell 4.4% to $3.71 billion and gross margin went down 69 basis points to 38.3%.

CEO’s Comments

The CEO of Kohl’s, Michelle Gass, said, “The year has started out below our expectations. Following a strong start to the quarter with positive low-single digits comps through late March, sales considerably weakened in April as we encountered macro headwinds related to lapping last year’s stimulus and an inflationary consumer environment.”

“We remain committed to our long-term strategy and are encouraged that our updated store experience, with Sephora at Kohl’s shops, delivered positive comparable store sales across these 200 locations for the quarter. We continue to expect our business to improve as the year progresses, with growth in the second half as we benefit from the rollout of 400 additional Sephora stores, enhanced loyalty rewards and further investment in our stores,” Gass added.

Outlook

Along with the first-quarter results, the company has also updated the Fiscal Year 2022 outlook. It expects EPS to range from $6.45 to $6.85, and operating margin between 7% and 7.2%.

About Kohl’s

Wisconsin-based Kohl’s runs a chain of department stores across the U.S., except Hawaii. At its more than 1,100 locations, the company offers apparel, shoes, accessories and home & beauty products.

Price Target

Based on six Buys, five Holds and one Sell, the stock has a Moderate Buy consensus rating. KSS’ average price target of $58.40 implies 24.3% upside potential from current levels. Shares have lost 20.6% over the past six months.

Website Traffic

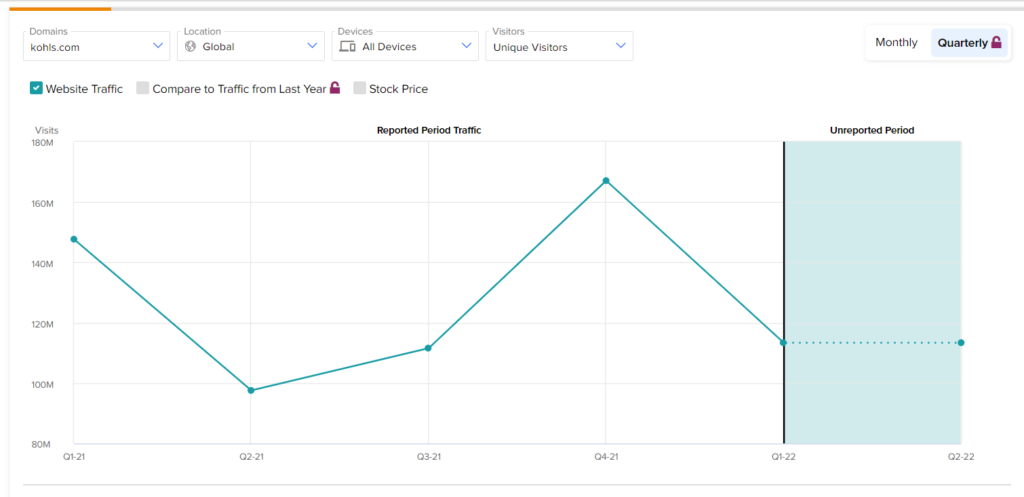

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Kohl’s first-quarter performance.

According to the tool, Kohl’s website traffic registered a 32.2% sequential fall in global visits in the first quarter. Further, the footfall on the company’s desktop website and mobile app has declined by 40.6% and 29.4%, respectively.

The downtrend in the company’s website visits supports the year-over-year decrease in its revenue and earnings. This shows that TipRanks’ website traffic tool helps in making reliable predictions about a company’s performance.

Conclusion

Kohl’s has been looking to sell itself for some time now. The weak first-quarter results will only make it harder for the company to negotiate a better deal for its shareholders. Meanwhile, it remains to be seen how Kohl benefits from the opening of Sephora at its stores.

At the time of writing, KSS stock was trading 3.6% down in Friday’s pre-market session.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Read full Disclaimer & Disclosure

Related News:

Boeing’s 737 MAX Aircraft in Limelight Again

Palo Alto Surges on Impressive Q3 Results and Robust Guidance

Spirit Airlines Fights JetBlue Over Acquisition by ULCC