Technology and manufacturing solutions provider Honeywell International (NASDAQ:HON) has agreed to acquire Carrier Global’s (NYSE:CARR) Global Access Solutions (GAS) business in a deal worth $4.95 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This all-cash M & A deal is expected to bolster Honeywell’s building automation capabilities. Earlier, the company had announced plans to realign its business verticals to the megatrends of automation, energy transition, and the future of aviation. The acquisition of Carrier’s GAS business is a part of this overarching strategy for the company.

The transaction encompasses both hardware and software solutions, integrating three brands – LeneIS2, Onity, and Supra – into Honeywell’s portfolio. LenelS2 specializes in commercial and enterprise access solutions, Onity offers electronic locks, and Supra provides cloud-based electronic real estate lock boxes.

Furthermore, the strategic move is expected to be cash-EPS accretive in the very first year of ownership and achieve a double-digit cash-ROIC (Return on Invested Capital) by the fifth full year of ownership. The deal remains subject to closing conditions and is anticipated to close by the end of Q3 2024.

Is HON a Good Stock to Buy?

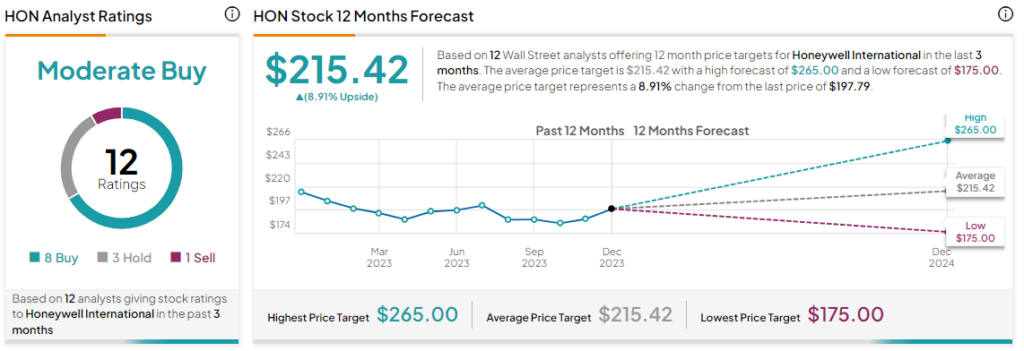

Today’s announcement has sent Carrier’s share price nearly 6% higher. On the other hand, Honeywell’s shares are trending over 2% lower. Overall, the Street has a Moderate Buy consensus rating on Honeywell and the average HON price target of $215.42 implies a modest 8.9% potential upside in the stock.

Read full Disclosure