Mobility solutions provider Lyft, Inc. (NASDAQ: LYFT) has reported better-than-expected results for the fourth quarter ended December 31, 2021. However, following the strong results, shares of the company declined more than 5.4% to close at $38.95 in Tuesday’s extended trading session.

Revenue & Earnings

Lyft’s quarterly revenues witnessed a year-over-year rise of 70% to $969.9 million. Further, the figure topped the consensus estimate of $939.06 million.

The company’s net loss during the quarter stood at $258.6 million, narrower than the loss of $458.2 million reported in the previous year.

Revenue per active rider witnessed a rise of 14.1% from the previous year to $51.79, while active riders increased 49.2% year-over-year to 18,728.

Lyft’s contribution margin improved from 55.5% in the previous year to 59.7%.

Management Commentary

The CEO of Lyft, Logan Green, said, “2021 was a big year. We strengthened our financial position and continued investing in exciting growth initiatives. I’m proud of the team for what we’ve accomplished together and I’m looking forward to building on our momentum.”

Stock Rating

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average Lyft price target of $61.46 implies that the stock has upside potential of 49.2% from current levels. Shares have declined 23.2% over the past year.

Website Traffic

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insights into Lyft’s performance this quarter.

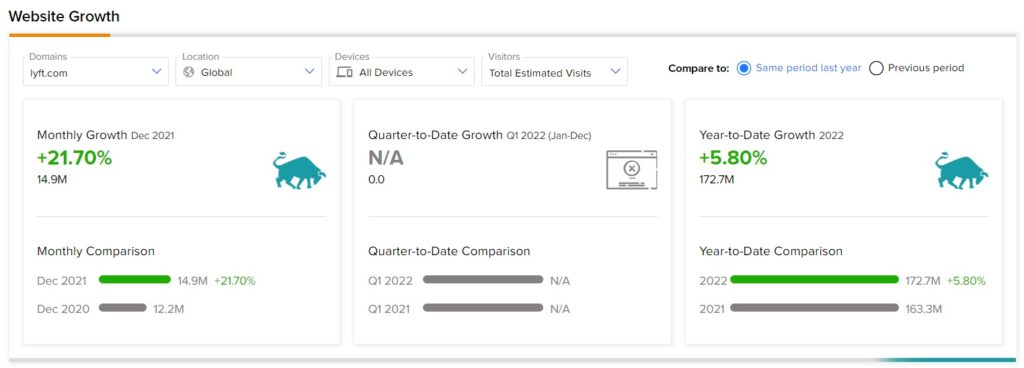

According to the tool, the Lyft website recorded a 21.70% monthly rise in global visits in December, compared to the same period last year. Further, year-to-date, the website traffic has grown 5.80%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Teradata Beats Q4 Earnings Expectations & FY2022 Outlook; Shares Up 7%

Spotify Agrees $320 Million Barcelona Sponsorship Deal – Report

Take-Two Posts Mixed Q3 Results; Shares Sink More Than 2%