American ridesharing service provider Lyft, Inc. (NASDAQ:LYFT) reported dismal third-quarter Fiscal 2022 results. Revenue of $1.05 billion missed the consensus estimates by $10 million. The company said the revenue was at an all-time high, growing 22% year-over-year and 6% sequentially. Also, Lyft’s Q3 diluted loss came in at $1.18 per share, significantly higher than the prior quarter. Following the news, LYFT stock plunged over 15% in after-hours trading yesterday.

On the other hand, in the quarter, Active Riders registered the slowest growth so far, growing 7.2% year-over-year to 20.31 million. Having said that, revenue per rider jumped to one of the highest levels, at 13.7%.

Lyft also reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $66.2 million, beating its own expectations. However, adjusted EBITDA and related margin were below the prior quarter and comparative quarter figures as the company posted a $135.7 million impairment charge related to non-marketable equity investments and other assets in the quarter.

What’s worse, the company’s fourth-quarter outlook fell short of Wall Street expectations. Lyft guided for Q4 revenue between $1.145 and $1.165 billion, while the consensus is pegged slightly higher at $1.17 billion.

Moreover, Q4 adjusted EBITDA is projected between $80 million and $100 million, while analysts estimate the number at $84.5 million.

To counter the narrowing margins, Lyft is undertaking expense reduction measures across headcount, and operating expenses like marketing, and office space. These steps will reduce costs by $350 million annually. Lyft also faces $82 million in insurance costs in Q4, which it states will be nullified by the expense-curbing initiatives.

What is the Forecast for LYFT Stock?

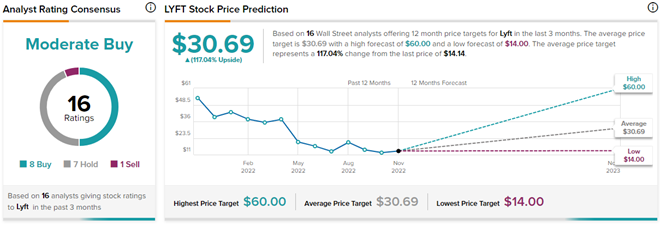

On TipRanks, the average Lyft price forecast is $30.69, which implies a massive 117% upside potential to current levels. Analysts have a Moderate Buy consensus rating on Lyft stock based on eight Buys, seven Holds, and one Sell rating.

A slew of macro factors has affected Lyft’s stock performance this year. Most importantly, Lyft stock will remain under pressure owing to driver supply issues, the economic slowdown, and the Department of Labor’s ruling on gig workers, the implications of which still remain unclear. Year to date, LYFT stock has lost 68.3%.