Lumentum Holdings Inc. (LITE) has reported strong results for the fiscal fourth quarter and full-year ended July 3, 2021, as both earnings and revenues surpassed expectations. Shares of the company rallied 1.8% on Wednesday.

Lumentum engages in the provision of optical and photonic products. It operates through Optical Communications and Commercial Lasers segments.

Q4 revenues soared 6.5% year-over-year to $392.1 million and surpassed the consensus mark of $382.2 million. This growth can be attributed to a 7.5% rise in revenues from Optical Communications segment, which contributed 90.6% to the total revenues.

Adjusted earnings came in at $1.15 per share, down 2.5% from $1.18 per share in the year-ago quarter. The Street had estimated the same to be at $1.05. (See Lumentum stock charts on TipRanks)

For Fiscal Year 2021, net revenues stood at $1.7 billion, up 3.8% year-over-year. Also, Lumentum reported EPS of $5.84 against $4.95 in Fiscal Year 2020.

The president and CEO of Lumentum, Alan Lowe, said, “While demand continues to grow into the first quarter, shortages of critical semiconductor components are negatively impacting our first quarter revenue outlook by more than $30 million.”

“We believe, however, the continuing shift in our demand mix towards differentiated products that enable next generation customer solutions is a leading indicator for growth over the coming years,” he added.

For the first quarter of fiscal 2022, the company expects to post net revenues in the range of $430 million to $445 million. Also, adjusted EPS is anticipated to be between $1.47 and $1.61.

Following the release, Needham analyst Alex Henderson assigned a Buy rating to the stock with a price target of $105 (upside potential of 28.6%).

Henderson said despite the prevailing headwinds “strong demand is driving better than expected outlooks in Industrial Lasers, Data Comm chips, and longer term demand for both Telecom Transport and Transmission products and even 3D Sensing.”

Consensus among analysts is a Hold based on 1 Buy and 3 Holds. The average Lumentum price target stands at $89 (upside potential of 9%).

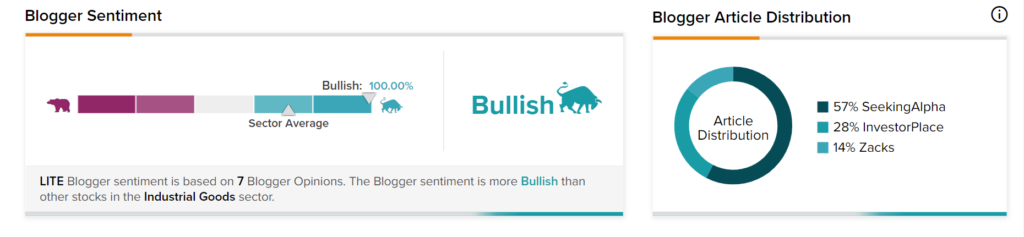

TipRanks data shows that financial blogger opinions are 100% Bullish on LITE, compared to the sector average of 72%.

Related News:

Overstock to Repurchase $100M Common Stock; Analysts Remain Bullish

Landstar Raises Guidance for Q3 on Positive Trend

T-Mobile Says Data of 7.8M Postpaid Customers Illegally Accessed