The pandemic-led lockdowns dragged down sales of major retailers and makers of discretionary goods like apparel and footwear due to the temporary closure of physical stores. Many US retailers have been experiencing improving sales trends since the gradual reopening of stores since May.

As per the National Retail Federation, retail sales continued to recover in August, showing a gradual improvement from July and larger gains Y/Y. However, the rate of improvement was slow compared to July.

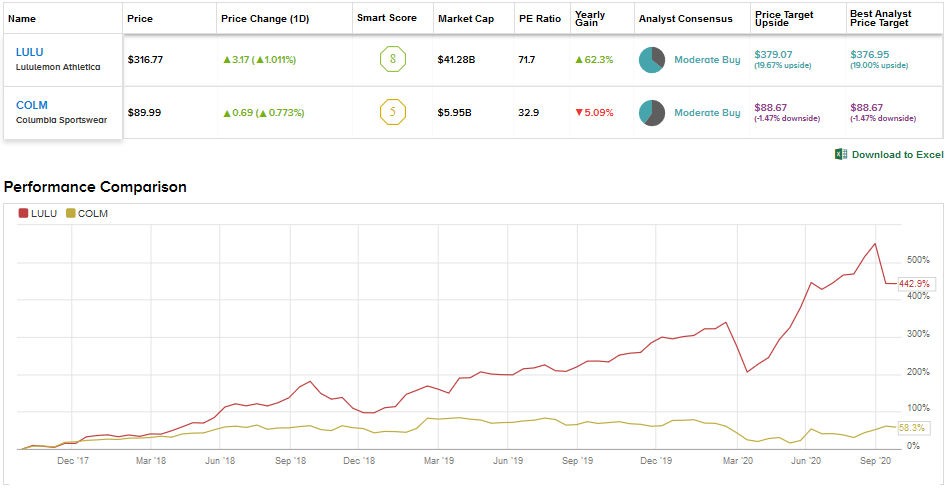

With the improving sales trends in the backdrop, we will use the TipRanks’ Stock Comparison tool to compare Lululemon and Columbia Sportswear to analyze which stock has better prospects.

Lululemon Athletica (LULU)

Canada-based Lululemon has grown rapidly over the years and emerged as one of the leading players in the athleisure space. Its premium yoga and athletic apparel offerings have helped in doubling revenue from $2.06 billion in fiscal 2015 to $3.98 billion in fiscal 2019. Lululemon’s revenue surged 21% in fiscal 2019, which ended on Feb. 2, 2020.

However, temporary store closures to curb coronavirus hurt Lululemon and caused a 6.7% revenue decline in the first half of fiscal 2020, ended Aug. 2. On the brighter side, continued investments in e-commerce channels over the years significantly boosted online sales amid the pandemic.

Fiscal 2Q revenue grew 2.2% to about $903 million as a 51% Y/Y decline in the revenue from company-operated stores was more than offset by strong e-commerce revenue growth of 155%. EPS fell about 23% to $0.74. In the 2Q conference call, Lululemon stated that about 97% of its stores have reopened and are performing (on average) at 75% of the prior year’s volume.

Looking ahead, the company continues to pursue its Power of Three growth plan, which aims to double men’s category revenue, double e-commerce revenue and quadruple international revenue by 2023.

Lululemon plans to open 30 to 35 net new stores in fiscal 2020. It is also accelerating its seasonal store strategy and plans to increase seasonal stores to 70 in the second half of the year compared to just over 50 in 2Q. On the merchandise front, the company intends to offer more inclusive size range in its women’s assortment and is also expanding presence in the run, train, yoga and on-the-move space.

Recently, Lululemon made its first acquisition—Mirror, the in-home fitness start-up which offers live classes through its $1,495 wall-mounted mirror device. Subscribers pay Mirror $39 per month to stream the classes. The company expects Mirror to generate revenue of over $150 million in fiscal 2020.

Lululemon stock has risen 36.8% year-to-date (as of Sept. 23) and the average analyst price target of $379.07 suggests further upside potential of about 20%.

On Sept. 14, Argus Research analyst John Staszak raised Lululemon’s price target to $380 from $360 and maintained a Buy rating. The analyst believes that with “substantial” opportunities to expand outside North America, particularly in China and growing e-commerce sales, Lululemon’s prospects “are among the best in the apparel sector.”

The analyst expects a transition to higher margin e-commerce sales and favorable operating leverage to result in enhanced operating margins over the next several years.

Overall, 18 Buys versus 10 Holds and no Sell ratings add up to a Moderate Buy consensus for Lululemon. (See LULU stock analysis on TipRanks)

Columbia Sportswear (COLM)

Columbia Sportswear sells outdoor and active lifestyle apparel, accessories, and equipment under four brands, Columbia (outdoor apparel and footwear), SOREL (fashionable footwear), Mountain Hardwear (mountaineering and outdoor athletic gear), and prAna (active and lifestyle apparel and accessories).

The company’s namesake Columbia brand accounted for 82% of the overall sales in 2019. Columbia Sportswear’s sales grew 8.6% in 2019 and the company predicted 2020 revenue growth in the range of 4.5% to 6%. However, COVID-19 dragged down sales by 25% in the first half of this year.

Second-quarter sales fell 40% to $316.6 million as most of the owned-stores as well as wholesale partners and international distributors’ doors were closed at the beginning of the quarter. Direct-to-consumer e-commerce sales grew 72% in 2Q and accounted for 28% of overall sales. Columbia Sportswear slipped into a net loss per share of $0.77 from EPS of $0.34 in 2Q last year. The company reopened almost all its stores by the end of July.

Meanwhile, to cater to online demand amid the pandemic, Columbia Sportswear continues to roll out its new mobile e-commerce platform, experience first, or X1. In 2019, the company implemented X1 across 10 countries in Europe and for the prAna brand in the US. It is on track to roll-out this platform to Columbia, Sorel and Mountain Hardwear brands in North America in the current quarter.

The company is also focused on launching several innovative products, including the Omni-Heat Black Dot apparel line. Meanwhile, the company intends to close underperforming stores and generate $100 million of targeted savings this year through cost containment efforts. (See COLM stock analysis on TipRanks)

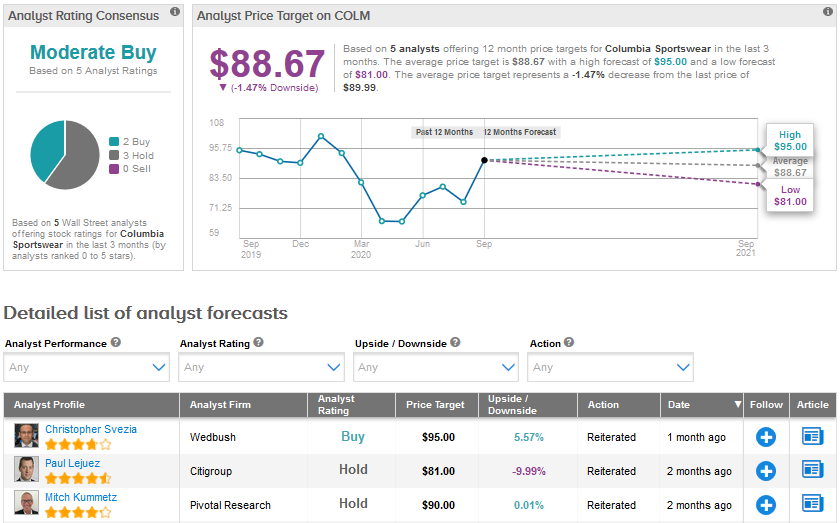

Last month, Wedbush analyst Christopher Svezia raised the price target for Columbia Sportswear to $95 from $88 and reiterated his Buy rating as virtual meetings with the company’s management left him incrementally positive on the near-term outlook and the opportunity in fiscal 2021.

The Street shares Svezia’s bullish outlook with a cautious Moderate Buy consensus based on 2 Buys, 3 Holds and no Sell ratings. Columbia Sportswear stock has declined 10.2% year-to-date and the average analyst price target of $88.67 indicates a possible downside of 1.5% ahead.

Conclusion

Lululemon’s valuation is very high compared to Columbia Sportswear. However, several analysts believe that the company’s consistent performance and strong growth prospects justify a premium valuation. Lululemom also showed higher resilience to the pandemic compared to Columbia Sportswear backed by its strong e-commerce business and product appeal.

Lululemon stock has significantly outperformed Columbia Sportswear so far and there is more upside potential ahead. Right now, Lululemon definitely appears to be a better choice.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment