Lululemon (NASDAQ:LULU) recently reported earnings for its second quarter. Adjusted earnings per share came in at $2.20, which beat analysts’ consensus estimate of $1.86 per LULU share. In the past nine quarters, the company has beaten estimates nine times.

However, sales increased 29% year-over-year, with revenue hitting $1.9 billion compared to $1.45 billion, higher than the $1.77 billion that analysts were looking for. This can be attributed to the company’s international and direct-to-consumer sales, which grew 35% and 30%, respectively.

However, gross profits increased by 25%, and the gross margin contracted from 58.1% to 56.5%. Nevertheless, the company still demonstrated operating leverage since operating income increased more than revenue. Indeed, operating income increased from $291.1 million in the comparable period to $401.2 million now – a 38% increase. This was the result of lower marketing as a percentage of revenue.

As a result of the company’s strong performance, management has raised its guidance for Fiscal Year 2022. Revenue is expected to be in the range of $7.865 billion to $7.940 billion, up from a range of $7.610 billion to $7.710 billion. Moreover, adjusted EPS is forecast to be between $9.75 to $9.90 compared to the previous guide of $9.35 to $9.50.

Investor Sentiment for LULU Stock is Currently Negative

The sentiment among TipRanks investors is currently negative. Out of the 560,536 portfolios tracked by TipRanks, 0.7% hold LULU stock. In addition, the average portfolio weighting allocated towards LULU among those who do have a position is 3.89%. This suggests that investors of the company are fairly confident about its future.

However, in the last 30 days, 0.9% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

Is LULU a Good Stock to Buy?

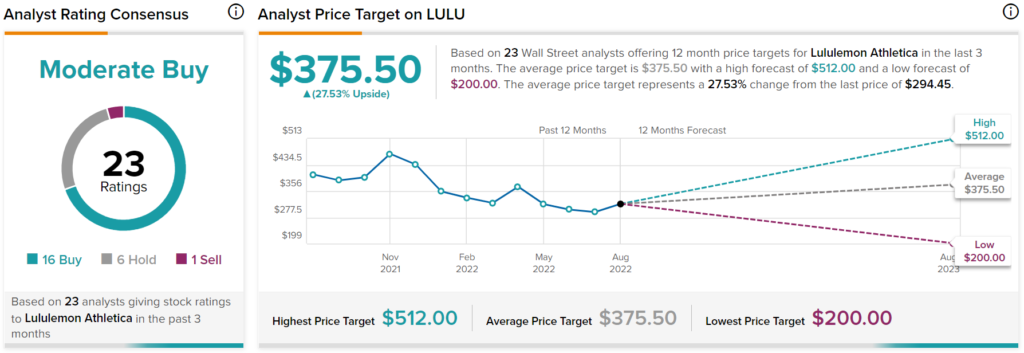

LULU has a Moderate Buy consensus rating based on 16 Buys, six Holds, and one Sell assigned in the past three months. The average LULU stock price target of $375.50 implies 27.5% upside potential.

Takeaway – Lululemon Has a Resilient Brand

While many other retailers have struggled, Lululemon highlighted the strength of its brand by posting a strong quarter. Revenue increased substantially on a year-over-year basis while adjusted earnings came in better than expected. This has given management the confidence to raise its Fiscal Year 2022 outlook during a time when many others have been lowering it.