American electric vehicle (EV) manufacturer, Lucid Group Inc. (LCID) signed a definitive agreement to set up its first non-US plant on Saudi Arabia’s west coast, according to Bloomberg.

At the time of writing, during pre-market trading, shares of the company were trading up more than 1% in anticipation of its fourth-quarter earnings results scheduled for today, after the market closes. LCID stock has lost 35.6% year-to-date.

Manufacturing Site in Saudi

According to the report, Lucid has signed a $30 million lease agreement with Emaar Economic City to build a manufacturing site in King Abdullah Economic City outside Jeddah. The lease has a tenure of 25 years and Lucid is expected to build an EV manufacturing, assembling, as well as ancillary services plant at the location. The kingdom’s sovereign wealth fund is also Lucid’s largest investor holding about 62% of the company.

Similar news was adrift in January, when Lucid Chairman Andrew Liveris, who is also a board member at Saudi oil giant Aramco, told Bloomberg TV that the company had planned to construct a manufacturing plant in Saudi by 2026. Similar news had floated last year, when Lucid and Public Investment Fund, also known as the Saudi wealth fund, were in talks to build a plant at the King Abdullah Economic City.

The government of Saudi Arabia is seeking to convert the site on the west coast into a carmaker’s hub, a step aimed at diversifying and developing non-oil industries in the region.

Consensus View

The LCID stock has a Hold consensus rating based on 1 Buy, 3 Holds, and 1 Sell. The average Lucid Group price target of $36.50 implies 38.5% upside potential to current levels.

News Sentiment

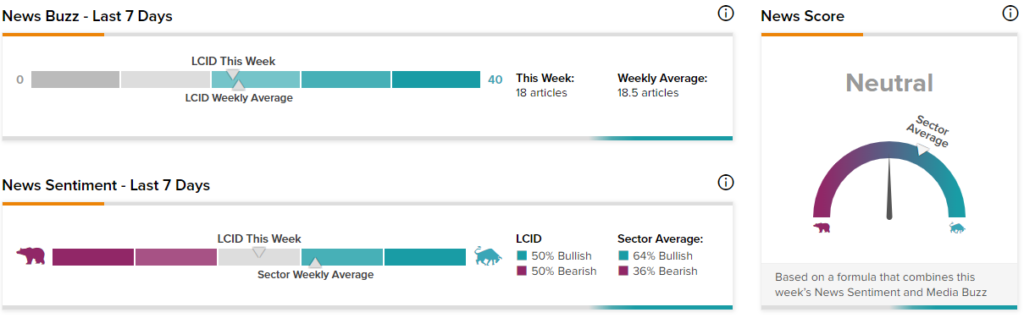

TipRanks data shows that the News Score for Lucid Group is currently Neutral based on 18 articles published over the past seven days, at the time of writing. 50% of the articles have a Bullish Sentiment compared to a sector average of 64%, while 50% of the articles have a Bearish Sentiment compared to a sector average of 36%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Moderna Soars 15% on Stellar Q4 Results

Block Surges 18% After-Hours on Robust Q4 Beat

Zscaler Plunges 15% Despite Q2 Beat