EV maker Lucid Group (NASDAQ:LCID) slid in trading on Tuesday after the company’s deliveries left analysts disappointed. Lucid delivered 1,457 vehicles during the third quarter, while analysts expected 2,000 vehicle deliveries. The company produced 1,550 vehicles during the third quarter, “plus over 700 additional vehicles in transit to Saudi Arabia for final assembly.”

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Saudi Arabia is a major investor in Lucid and has agreed to purchase up to 100,000 Lucid vehicles over a ten-year period. This includes an initial commitment to purchase 50,000 vehicles and an option to acquire up to an additional 50,000 vehicles. The company is expected to report its Q3 results on November 7.

What is a Good Price for LCID Stock?

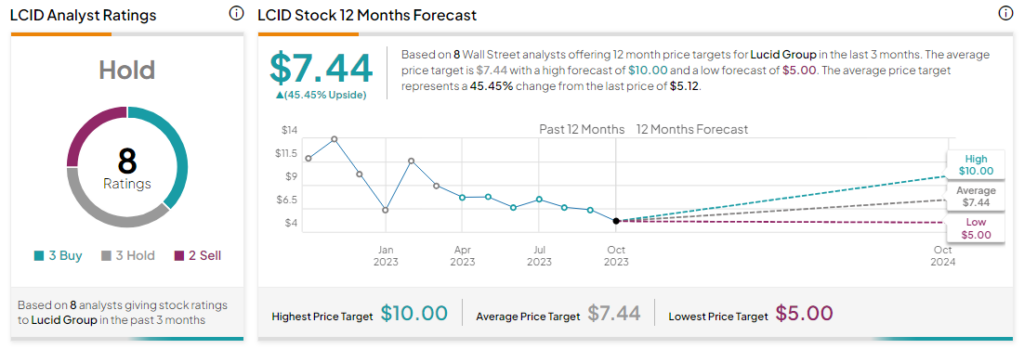

Analysts remain sidelined about LCID stock with a Hold consensus rating based on three Buys, three Holds, and two Sells. The average LCID price target of $7.44 implies an upside potential of 45.45% at current levels.