Lucid Group, Inc. (LCID) reported weaker-than-expected fourth-quarter results, pushing the shares down 14.5% during yesterday’s extended trading session. Both revenue and loss numbers for the American electric vehicle (EV) start-up company missed expectations by huge margins. The company attributed the poor results to ongoing supply chain and logistics issues, and quality focus.

The lucid stock closed up almost 10% at $28.98 on February 28, in anticipation of upbeat Q4 results and on the company’s announcement of building a first non-U.S. manufacturing plant in Saudi Arabia.

The company said it delivered 125 EVs as of December 31, 2021, and to date, it has delivered over 300 autos.

As of February 28, its production exceeded 400 vehicles. Notably, against its previous guidance of 20,000 units, the company has lowered its 2022 production outlook for Lucid Air to fall in the range of 12,000 to 14,000 autos.

Weaker-than-Expected Results

Lucid’s Q4 revenue of $26.39 million missed analysts’ estimates of $36.7 million. For the prior-year quarter, Lucid recorded revenue of $3.63 million. Lucid started the initial deliveries of Lucid Air Dream Edition in October 2021.

Furthermore, Lucid’s Q4 loss of $0.64 per share came in 29 shares worse than analysts’ estimated loss of $0.35 per share.

For full-year 2021, Lucid reported a loss of $6.41 per share on revenue of $27.11 million. In FY20, Lucid reported a loss of $28.42 per share on revenue of $3.98 million in the prior year.

Official Comments

Commenting on Lucid’s performance, CEO and CTO, Peter Rawlinson, said, “We’re updating our outlook for 2022 production to a range of 12,000 to 14,000 vehicles. This reflects the extraordinary supply chain and logistics challenges we’ve encountered and our unrelenting focus on delivering the highest quality products. We remain confident in our ability to capture the tremendous opportunities ahead given our technology leadership and strong demand for our cars.”

Additionally, the company’s CFO, Sherry House, said, “We met our target of opening 20 Studio and Service locations in North America; in 2022 we will expand our footprint in Europe and the Middle East while laying the foundation for a later expansion into the Asia Pacific; we remain on track to grow our Casa Grande facility to nearly quadruple its size as the first greenfield dedicated EV factory in North America; and today we announced plans to build a brand new manufacturing facility in the Kingdom of Saudi Arabia.”

Stock Prediction

The LCID stock has a Hold consensus rating based on 1 Buy, 3 Holds, and 1 Sell. The Lucid Group stock prediction of $36.50 implies 25.9% upside potential to current levels. Its shares have lost 5.4% over the past year.

Blogger Opinions

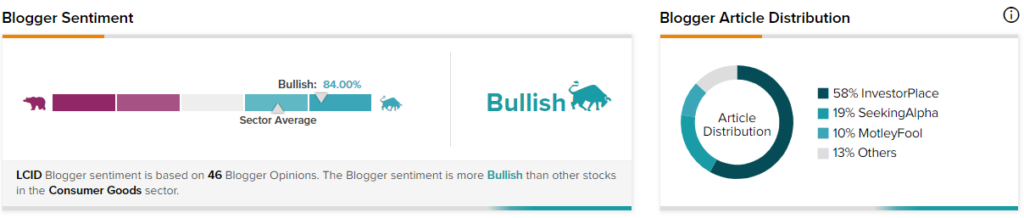

TipRanks data shows that financial blogger opinions are 84% Bullish on LCID, compared to a sector average of 71%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Li Auto Gains 2% on Q4 Beat & Positive Guidance

Foot Locker Plummets 30% on Weak FY22 Outlook Despite Q4 Beat

Uber Alters Algorithm to Enhance Driver Pay – Report