Shares of aerospace and defense company Lockheed Martin (LMT) are up in today’s trading as investors await its Q3 earnings results on October 22 before the market opens. Analysts are expecting earnings per share to come in at $6.50 on revenue of $17.4 billion. This represents a decline from the $6.77 per share seen in the year-ago period, according to TipRanks’ data.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, it seems likely that the firm will beat earnings estimates, as it has done so for eight consecutive quarters. Interestingly, in most instances, the beats were by amounts that were greater than the $0.27 difference between last year’s results and this quarter’s expectations. As a result, it is still possible that LMT will be able to exceed last year’s figure.

In addition, Bullish analysts are optimistic about the firm’s planned acquisition of satellite manufacturer Terran Orbital (LLAP), as they believe it will enhance its Space Development operations. They also point to new contracts secured by Lockheed that are worth $5.1 billion as a major catalyst for the stock price. However, there are still some negatives to consider. Probably the most important factor is the defense industry’s outlook, which could be slowing down due to a deceleration in defense spending growth.

Options Traders Anticipate a Large Move

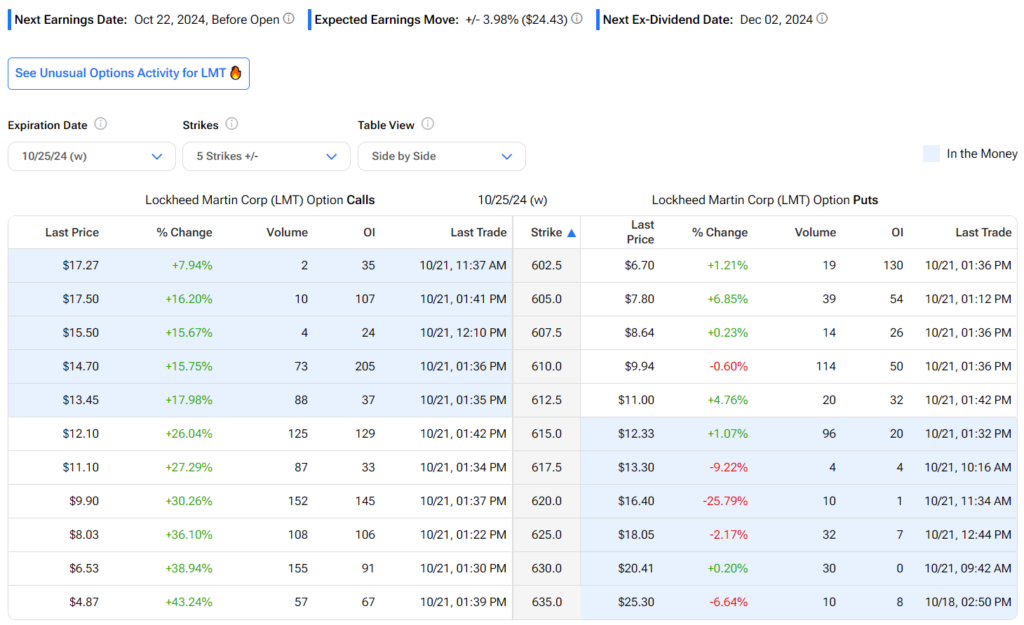

Using TipRanks’ Options tool, we can see that options traders are expecting a 3.98%, or $24.43, move from LMT stock in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

In this scenario, the call option on the $615 strike price is worth $12.10, while the put option for the same strike price is worth $12.33, for a total of $24.43. It’s worth noting that LMT’s after-earnings price moves have historically mostly been smaller than the 3.98% that is expected. This implies that current option prices might be overvalued.

Is LMT a Buy, Hold, or Sell?

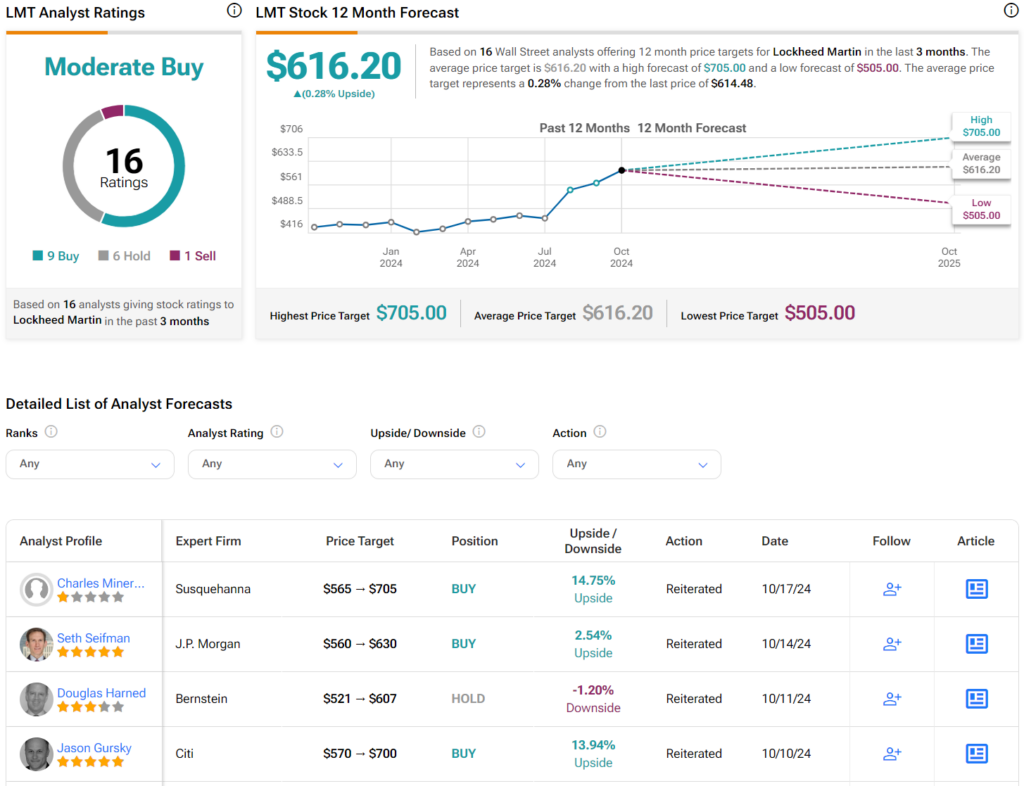

Overall, analysts have a Moderate Buy consensus rating on LMT stock based on nine Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 41% rally in its share price over the past year, the average LMT price target of $616.20 per share implies that shares are trading near fair value.