Lockheed Martin Corporation’s (LMT) merger with Aerojet Rocketdyne Holdings, Inc. (AJRD) has hit a major hurdle as the U.S. Federal Trade Commission (FTC) decided to block the deal backed by a unanimous vote.

Lockheed Martin is an American aerospace, arms, defense, information security, and technology corporation with worldwide interests.

Aerojet Rocketdyne is the last independent U.S. supplier of missile propulsion systems. It deals in the supply of advanced power, propulsion, and armament systems, which are critical components for the missiles made by Lockheed and other defense contractors.

The FTC seeks to file a complaint in the U.S. District Court for the District of Columbia demanding a preliminary injunction to stop the deal. The administrative trial is scheduled to begin on June 16, 2022.

Regulator’s Concerns

The FTC believes that the $4.4 billion deal will likely allow Lockheed Martin to control the critical propulsion inputs supplied by Aerojet, by denying, limiting, or otherwise disadvantaging competitors’ access to inputs for various weapon systems. This is expected to harm competition among several weapon-system providers.

Also, the combined company could affect competition by raising prices of inputs, degrading the quality of the product, and altering the schedule and contract terms for developing and supplying inputs to rivals.

Further, Lockheed Martin will gain access to prime contractors’ sensitive information about technological advancements, costs, schedules, and business strategies, which it could use to gain a competitive advantage.

FTC Bureau of Competition Director, Holly Vedova, said, “If consummated, this deal would give Lockheed the ability to cut off other defense contractors from the critical components they need to build competing missiles. Without competitive pressure, Lockheed could jack up prices while delivering lower quality and less innovation. We cannot afford to allow further concentration in markets critical to our national security and defense.”

The decision has been taken after considering feedback provided by the U.S. Department of Defense (DoD). The DoD conducted several FTC-led interviews with DoD-impacted stakeholders.

Analyst Recommendations

Last week, Jefferies analyst Sheila Kahyaoglu maintained a Hold rating on Lockheed Martin with a price target of $350 (9.6% downside potential from current levels).

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 3 Buys and 5 Holds. The average Lockheed Martin price target of $386.13 implies 0.3% downside potential to current levels.

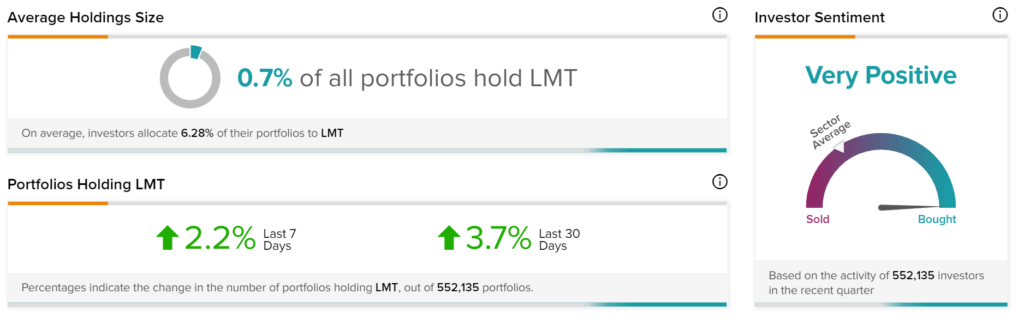

Positive Investor Sentiment

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Lockheed Martin, with 3.7% of investors increasing their exposure to LMT stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Texas Instruments Shares Gain 3.7% on Strong Q4 Results

Verizon Posts Better-Than-Expected Q4 Results

Coca-Cola Collaborates with Molson Coors for Another Alcoholic Drink