Tesla (NASDAQ:TSLA) shares continued a four-day-long slide on Friday, closing the week with another loss – 3.7% for the day, and 9% for the week.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bloomberg blamed Friday’s losses on a couple of news items. In Europe, the company had to idle production at its Berlin Model Y plant after Houthi attacks on commercial shipping in the Red Sea knocked a link out of the supply chain Tesla needs to build the electric crossovers. Tesla will need a couple of weeks to get the chain repaired and restart production – probably around February 12.

Meanwhile on the other side of the world, the price war among Chinese electric vehicle manufacturers is still raging – and still taking its toll on Tesla. To compete with local companies such as BYD (which recently overtook Tesla in global EV sales), Tesla is cutting Chinese prices on its popular Model 3 and Model Y vehicles by 6% and 3%, respectively.

And yet, while many investors seem worried over these short-term concerns, Baird analyst Ben Kallo is keeping his eye on the long-term story – and particularly, on Tesla’s ability to grow production volume and get its long-awaited Model 2 economy car into production. Publishing a note yesterday answering some of the banker’s “most frequently asked questions,” Kallo reassured investors that Baird continues “to recommend TSLA as a core holding.”

But he didn’t start out on a very optimistic note. Tesla is widely understood to be trying to grow its production by 50%, year in and year out. Kallo doesn’t think that’s likely to happen in 2024, though, guesstimating 16% growth is more likely this year. However, the analyst says there are “several levers could help TSLA beat estimates for deliveries.”

Many of these center on not the Chinese market, but the U.S. market for EVs. For example, Model 3 and Model Y are expected to get a refresh soon, which could spur car-buyer interest. Cybertruck sales should be increasing this year as well, and Tesla Semi sales as well. Meanwhile, one thing that has worried many Tesla investors in recent weeks – the U.S. government’s changing the rules for how carmakers/car buyers can qualify for income tax rebates on EVs – could actually work to Tesla’s advantage, says Kallo.

On the one hand, yes, the Model 3 WD and LR models have both lost access to the entirety of the government’s $7,500 tax credit. But many competing automakers’ models have lost their credits as well. In a winnowed field, Kallo argues that, since at least some Tesla models still get the credit, this change to the tax laws “could actually favor TSLA.”

A second issue worrying investors concerns Tesla’s operating profit margin, which has been cut in half over the past year. That’s bad news. But the good news, according to Kallo, is that this is probably as bad as things will get, and Tesla “is very close” to “trough” profit margins at present. It’s always darkest before the dawn, and assuming Tesla can keep margins from eroding any further, while rivals’ margins remain largely negative, this too is a trend that could work to Tesla’s benefit.

Furthermore, a lot of investors would feel a whole lot happier about Tesla if it would hurry up and start selling some Model 2s – perhaps the single best bet for reigniting enthusiasm around Tesla stock. On that subject, however, Kallo’s news is downbeat: The Model 2, he says, will not arrive before H1 2026.

Overall, Kallo’s long term outlook is bright for TSLA, and he backs it with an Outperform (i.e. Buy) rating and a $300 price target that implies a one-year upside potential of 37% for the stock. (To watch Kallo’s track record, click here)

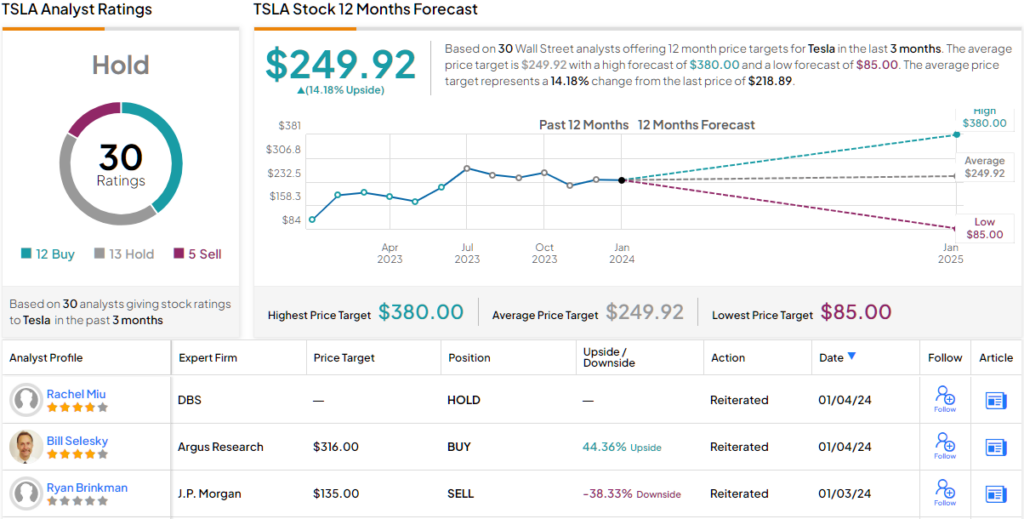

The rest of the Street is less confident, however; based on 12 Buys, 13 Holds, plus 5 additional Sells, the stock has a Hold consensus rating. The average price target currently stands at $249.92, suggesting shares will rise ~14% over the next 12 months. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.