Link Administration Holdings Ltd. (ASX:LNK) shares plunged as much as 5.5% today, to a low of AU$3.28. The stock declined after Link’s board rejected a revised buyout offer from Canada’s Dye & Durham.

Link is a multinational provider of administrative services, such as investment fund management and share registry tools. It had agreed to be acquired by Dye & Durham for AU$2.5 billion. However, the deal hit a hurdle after the UK’s Financial Conduct Authority (FCA) required the parties set aside AU$519 million to cover potential fines, before it could approve the transaction.

After reviewing the FCA’s condition Dye & Durham decided to lower its takeover offer for Link. In response, Link’s board rejected Dye & Durham’s reduced buyout offer.

Is Link Administration stock a good investment?

Link shares have dropped about 25% over the past month and have declined nearly 40% year-to-date. However, analysts remain bullish on LNK stock. According to TipRanks’ analyst rating consensus, Link stock is a Moderate Buy based on four Buys and three Holds. The average Link shares price target of AU$4.41 implies over 30% upside potential.

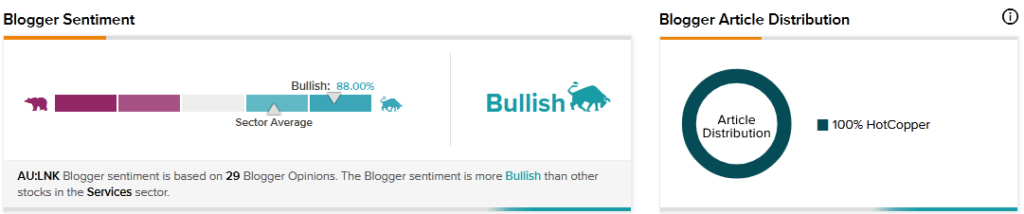

LNK stock is seeing favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 88% Bullish on LNK, compared to a sector average of 69%. Moreover, LNK shares offer an above-average dividend yield of 2.45%.

Final thoughts

The rejection of Dye & Durham’s reduced buyout offer shows the Link team believes no deal is better than a bad deal. While the immediate market reaction wasn’t positive, Link has signalled confidence, that it can chart its own course over the longer term, without Dye & Durham.