Shares of Levi Strauss & Co. plunged almost 9% in Thursday’s pre-market trading session after the jeans giant’s first-quarter guidance fell short of analysts’ expectations.

Levi Strauss (LEVI) expects first-quarter adjusted earnings per share to be in the range of $0.20 to $0.24, lagging the Street consensus of $0.33 cents per share. Sales in 1Q of 2021 are forecasted to be down by high-teens in constant currency terms year-on-year. Analysts had projected a decline of 11.9%.

The jeans retailer stated that net revenues, earnings and cash flows, will continue to be significantly adversely impacted for at least the first half of 2021 due to the resurgence in COVID-19 cases. The company cautioned about the possibility of additional pandemic-led inventory and other charges in the offing.

Levi Strauss reported that 17% of its stores globally were temporarily shut down due to the rise in coronavirus cases, which also led to closures of 40% of its full store footprint in Europe. As a result of the store closures, the company expects its EPS in 1Q to be lower by $0.10 to $0.12.

In the fourth quarter of 2020, the company’s sales dropped about 12% to $1.39 billion, but topped analysts’ estimates of $1.34 billion. Levi Strauss posted adjusted EPS of $0.20 during the quarter, exceeding the consensus estimates of $0.15. Additionally, the company also reinstated its quarterly dividend at 4 cents per share.

“The steps we took on structural costs, cash management, agility and new capabilities helped drive results far ahead of our own expectations and give me great confidence in our future,” said Levi Strauss CEO Chip Bergh. “We will double down on elevating our iconic brand, investing in direct engagement with our fans, advancing our fast-growing digital business and further diversifying our portfolio. As we continue to accelerate these strategic focus areas, we will emerge a stronger, more profitable, more agile company.”

Levi Strauss CFO Harmit Singh stated that if conditions do not worsen, the company expects to return to “pre-pandemic revenues by the end of 2021, with Adjusted EBIT margins of twelve percent or more.”

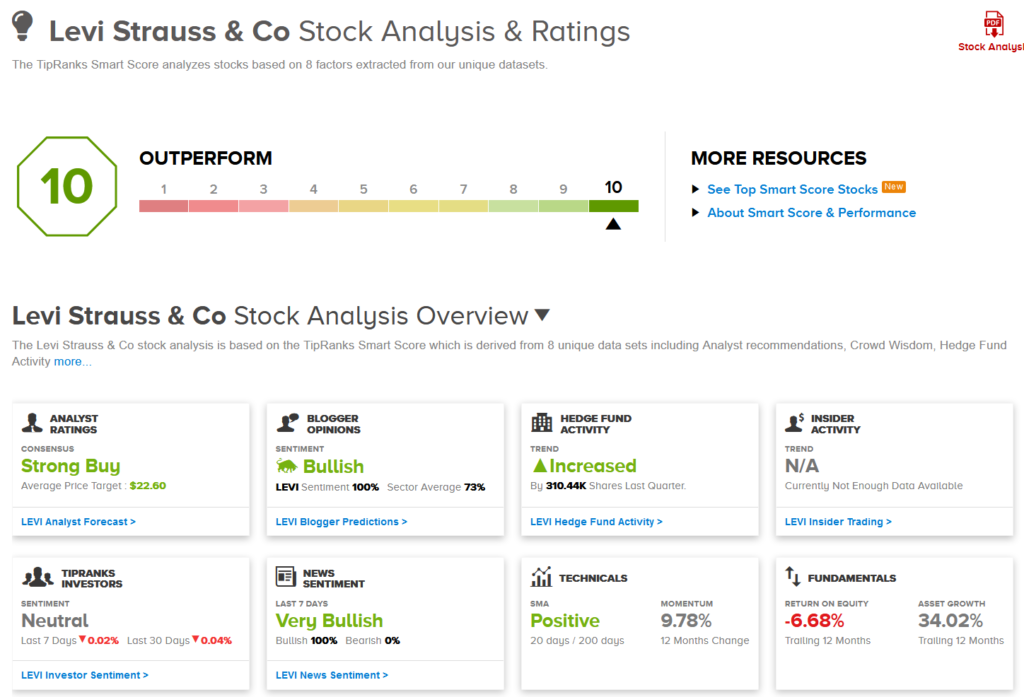

Shares of LEVI have jumped 35% over the past three months, with the average analyst price target of $22.60 translating into 2.7% upside potential over the coming 12 months.

Following the earnings results, Guggenheim analyst Robert Drbul maintained a Buy rating on the stock with a $24 price target as he argues that LEVI continues to “play offense” from an investment standpoint while cutting expenses in other areas, which he expects will drive EBIT margin above 12% in 2022.

“We believe the organic health of Levi’s business is getting better overall. We are encouraged by the company’s offensive strategy, strong brand, experienced management team, and healthy financial position,” Drbul wrote in a note to investors.

“We believe a premium multiple is warranted as LEVI’s top line continues to improve toward a structurally higher post-COVID profit margin structure,” the analyst concluded.

The rest of the Street shares Drbul’s bullish outlook backed firmly by 5 unanimous Buy ratings, which add up to a Strong Buy consensus rating. (See Levi Strauss stock analysis on TipRanks)

What’s more, LEVI scores a perfect 10 on TipRanks’ Smart Score system, indicating that the stock has strong potential to outperform market expectations.

Related News:

AMC Explodes 301% After $305M Share Sale; Street Says Hold

NCR To Snap Up Cardtronics For $2.5B; Street Says Buy

AMC Secures $917M Lifeline To Avert Bankruptcy; Shares Pop 26%