Lennar Corporation (NYSE: LEN), a home construction company, reported better-than-expected results for the first quarter of Fiscal Year 2022 (ended February 28). A strong housing market and margin expansion acted as tailwinds.

Following upbeat results, shares of the company rose 1.68% in Wednesday’s extended trading session after closing 2.6% higher on the day.

Results in Detail

Lennar reported adjusted earnings of $2.70 per share, topping analysts’ expectations of $2.60. The company recorded earnings of $2.04 per share in the same quarter last year.

Total revenues of $6.2 billion beat the Street’s estimate of $6.11 billion and increased 16% from the year-ago period.

On a segmental basis, revenues from home sales came in at $5.7 billion in the quarter, up 17% year-over-year, driven by a 2% rise in the number of home deliveries. Gross margin on home sales was 26.9%, up 190 basis points.

Operating earnings for the Financial Services segment stood at $90.8 million, down 37.9% on the back of reduced mortgage net margins.

The Multifamily segment reported operating earnings of $5.4 million in the quarter, compared with the operating loss of $0.9 million in the prior-year quarter.

Remarkably, Lennar recorded above-expectation quarterly new orders and deliveries. Total 15,747 new orders were reported, above the consensus estimate of 14,985, while total deliveries stood at 12,538, surpassing analysts’ expectations of 12,524.

As of February 28, 2022, Lennar had $1.4 billion of homebuilding cash and cash equivalents and nil borrowings under its $2.5 billion revolving credit facility.

Capital Deployment

During the reported quarter, the company repurchased 5.3 million shares of its common stock for $526.3 million at an average price of $99.90 per share.

Recently, the company’s Board of Directors increased the common stock repurchase authorization by $2 billion.

Guidance

Encouragingly, Stuart Miller, Executive Chairman of Lennar, said, “The housing industry continues to exhibit strong demand, outweighing supply, and we are confident that we will continue to generate solid growth and enhance our current market position.”

For Q2 2022, the company expects home deliveries to land between 16,000 and 16,300, with homebuilding gross margins anticipated in the range of 28% – 28.25%.

Despite industry concerns like supply-chain constraints, building costs, and rising mortgage rates to hurt the affordability of homes, for Fiscal 2022, Lennar has revised guidance for both deliveries and gross margin. It expects to deliver about 68,000 homes, up from prior expectations of 67,000. Additionally, homebuilding gross margins are likely to be between 27.25% and 28.0%, up from the prior range of 27% to 27.5%.

Wall Street’s Take

The Street is cautiously optimistic about the stock, which has a Moderate Buy consensus rating. That’s based on 10 analysts suggesting a Buy, two analysts recommending a Hold, and one suggesting a Sell. The average Lennar price target of $126 implies a 42.36% upside potential to levels before market open on Thursday. Shares of the company have lost 11.31% over the past year.

Bloggers Weigh In

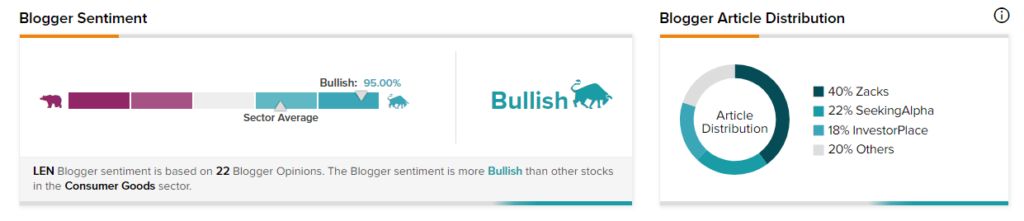

Bloggers seem enthused by the company’s earnings results. TipRanks data shows that financial blogger opinions are 95% Bullish on LEN, compared to a sector average of 68%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford to Expand EV Footprint in Europe

ExxonMobil Fails to Rescind Appeal to Terminate Climate Change Investigations

Intel to Invest €80B to Expand Footprint in European Union