Shares of Lennar Corp. popped 3.8% in Wednesday’s extended trading after the homebuilder reported better-than-expected 4Q results, driven by strong housing demand.

Lennar (LEN) reported 4Q earnings of $2.82 per share, which increased 32.4% year-over-year and topped the Street’s estimates of $2.37 per share. The company’s 4Q sales of $6.83 billion also exceeded the consensus estimates of $6.65 billion, but declined 2% year-on-year.

Lennar’s executive chairman Stuart Miller said that during the fourth quarter, “The confluence of Millennials starting families and creating households of their own, along with the pro-housing effects of the COVID-19 pandemic, has materially strengthened demand. This surge in demand for housing, combined with the market’s inability to produce sufficient homes to meet this demand, has exacerbated the already well-documented undersupply of new and existing homes for sale.” (See LEN stock analysis on TipRanks)

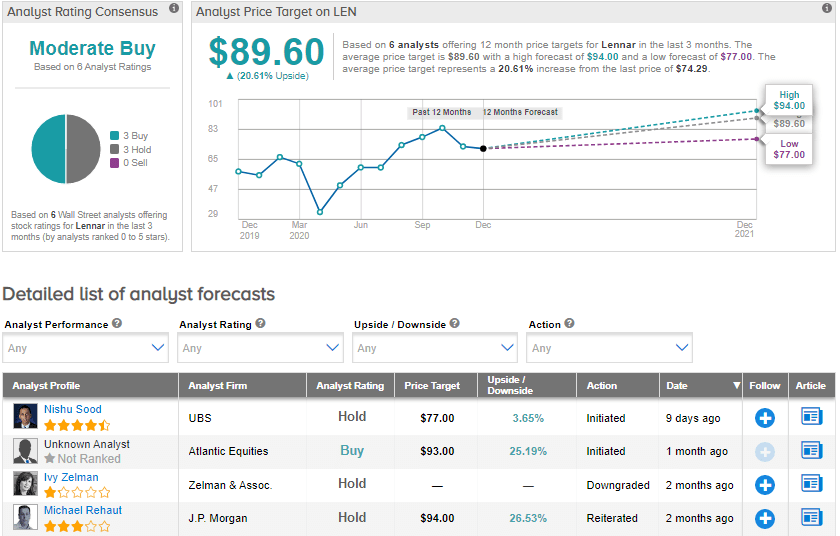

On Dec. 8, UBS analyst Nishu Sood initiated coverage on Lennar stock with a Hold rating and a price target of $77 (3.7% upside potential). The analyst said that companies dealing with new home construction and remodeling will “fade sharply”, while commercial construction companies will return to normal rates.

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 3 Buys and 3 Holds. The average price target stands at $89.60 and implies upside potential of about 20.6% to current levels. Shares have gained 33.2% year-to-date.

Related News:

Quest Lifts 2020 Sales, Profit Guidance As Covid-19 Testing Picks Up

Aspen Group Sinks 7% On Higher 2Q Loss; Street Stays Bullish

Dixons Pops 15% As Online Sales Go Through The Roof; Street Sees 10% Downside