Lear Corp.’s 3Q earnings of $3.73 per share increased 5.4% year-over-year and crushed analysts’ estimates of $3.14. The manufacturer of automotive seating and automotive electrical systems reported revenues of $4.9 billion that improved 2.1% year-over-year and surpassed the Street estimates of $4.7 billion. The company’s 3Q outperformance leaned on a rebound in vehicle production from the 2Q .

Lear Corp.’s (LEA) global vehicle production declined 4% year-over-year in 3Q. However, the company said that global vehicle production “recovered significantly versus the prior quarter.”

The company’s CEO Ray Scott said that “I am very pleased with how quickly the industry recovered and our business rebounded after the second quarter shutdowns, and, barring any COVID-19-related disruptions or a significant change in industry demand, I am optimistic that our positive momentum will continue for the balance of the year.” (See LEA stock analysis on TipRanks).

As for 2020, the company believes that there is “still uncertainty” related to the COVID-19 pandemic, even though “industry conditions have stabilized over the last few months.” The company expects 2020 revenues in the range of $16.35-16.65 billion, versus the consensus estimate of $16.45 billion.

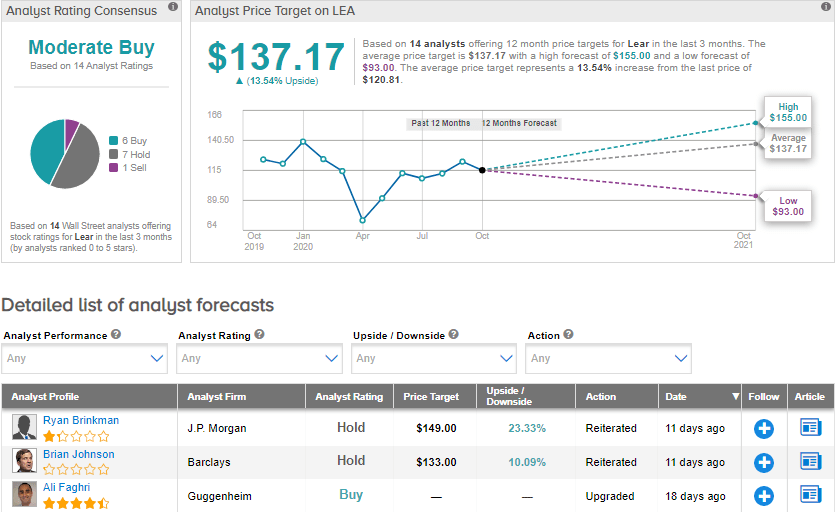

On Oct. 22, J.P. Morgan analyst Ryan Brinkman raised the stock’s price target to $149 (23.3% upside potential) from $125, while maintaining a Hold rating. The analyst expected auto parts suppliers to top 3Q earnings’ expectations due to “much stronger” production in China. Brinkman also anticipated modestly stronger production in North America and a slight increase in the production in Europe.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys, 7 Holds and 1 Sell. The average price target of $137.17 implies upside potential of about 13.5% to current levels. Shares have declined by about 12% year-to-date.

Related News:

Ford Targets Sale Of 100,000 Hands-Free Cars In First Year

Tesla 3Q Profit Blows Past Estimates; Street Says Hold

O’Reilly Bumps Up Share Buyback Plan By $1B After 3Q Profit Beat