In our article titled, “What are Dividend Aristocrats? Should you Invest in Them?” we learned that stocks paying dividends consistently and increasing their dividends for at least 25 consecutive years are referred to as Dividend Aristocrats. Moreover, we learned about the pros and cons of investing in dividend aristocrats. Today, we will study how many stocks are currently on the Dividend Aristocrats list.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

S&P Global (NYSE:SPGI), a provider of independent ratings, benchmarks, analytics, and data company started the S&P 500 Dividend Aristocrats index in May 2005. The index includes S&P 500 (SPX) companies that have increased dividends every year for the last 25 consecutive years. Each constituent is equal-weighted, and the company conducts the rebalancing of the Dividend Aristocrats index quarterly in January, April, July, and October.

The other two criteria for inclusion in the index are having a “float-adjusted” market capitalization of at least $3 billion on the rebalancing date, and stocks must have an average daily trading value of at least $5 million for the three months preceding the rebalancing date. Additionally, the index must contain a minimum of 40 constituents on each rebalancing, and no particular sector must account for more than 30% of the index weight.

Based on the above conditions, as of June 20, 2023, there are 66 stocks in the S&P 500 Dividend Aristocrats index. During the rebalancing in 2023, three stocks that were added to the list included CH Robinson (NASDAQ:CHRW), Nordson (NASDAQ:NDSN), and JM Smucker (NYSE:SJM). On the other hand, VF Corporation (NYSE:VFC) was removed from the Dividend Aristocrats list when it announced a cut to its dividend in February 2023.

The current sectoral breakdown of the Dividend Aristocrats index shows that the consumer staples sector has the highest weighting at 24%, followed by industrials at 22.8% and the materials sector at 12.2%.

TipRanks also has a dedicated Dividend Aristocrats page, which displays the list of dividend stocks as compiled by the S&P 500 Dividend Aristocrats index. To navigate to the page, on the main menu, go to Dividends –> Dividend Aristocrats.

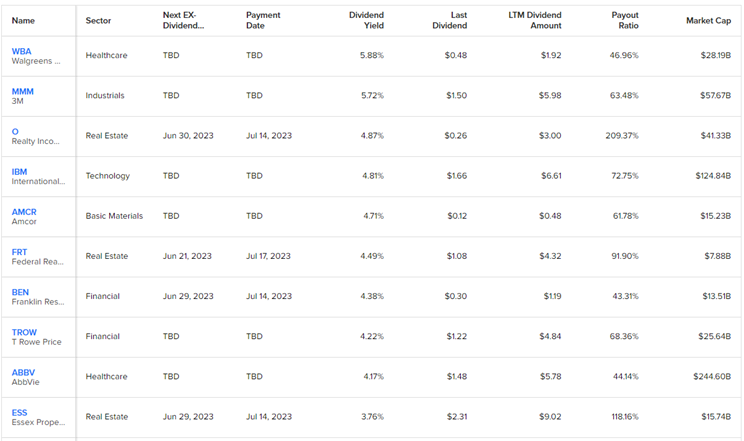

Sorted by dividend yield, below are the top 10 Dividend Aristocrats on TipRanks:

Ending Thoughts

Investing in Dividend Aristocrats appears to be a solid way of earning regular dividend income coupled with modest stock price appreciation. Dividend Aristocrats often have sound business models, healthy balance sheets, and recession-proof offerings. Research these stocks with the multitude of TipRanks’ unique tools and see how they can bring much-desired stability to your portfolio.