Wall Street Analysts often study the key parameters and metrics of industries and companies and give their viewpoints on a sector’s expected performance. Today we will see which sectors are the winners and losers for the months ahead, as per the analysts’ views.

2022 has been an iconic year so far, marked by a slew of macroeconomic headwinds. First, the Russia-Ukraine war triggered record high fuel prices, followed by historically high inflation numbers. This was followed by a series of disappointing earnings from big tech firms and social media companies.

As if that was not enough, retailers barged in with huge markdowns on unsold products, citing massive inventory pile-ups. And to top it off, companies from all walks of life have started reducing their workforce to curtail expenses.

On the bright side, however, TipRanks data shows that Wall Street analysts have turned more optimistic across sectors. Plus, they have adjusted the target prices higher for several companies as against the number of times they have lowered the price targets. Let’s look at which sectors are the most preferred by analysts currently and which are the least preferred.

Here’s what TipRanks’ data shows:

1) The Number of Buy Ratings on Stocks

TipRanks data suggests that the percentage of Buy recommendations on a whole has increased in 2022 as compared to the previous three years. This is proven by the chart below, which shows that 62.72% of analyst ratings were “Buy” in 2022 against 57.59% in 2020.

As the ill effects of the pandemic are behind us in 2022, analysts have increasingly upgraded stocks from Sell to Hold, and from Hold to Buy ratings.

2) Price Target Increases vs. Decreases

TipRanks data shows that in 2022, a majority of analysts have decreased the price targets on technology stocks. Although analysts have held their conviction in the sector, supply chain disruptions, labor issues, an inflationary environment, and rising interest rates have all led to weak quarterly performances from companies in the sector. Moreover, some companies have even lowered their outlook, citing macro concerns. In tandem with the companies’ outlook, analysts too have reduced their future expectations of tech companies and reduced their price targets.

Notably, 68.63% of analyst calls have been accompanied by price target cuts for the technology sector. On the other hand, only 25.24% of calls have increased the price targets for this sector.

On the contrary, analysts have increased the price targets on Utility stocks in 2022. Electricity, oil and gas, and green energy companies form a part of this sector. Oil prices have marked record highs in 2022, no wonder analysts have been exceedingly bullish about the sector’s performance. Companies reported solid results in the first half of 2022 and gave a compelling outlook for the rest of the year. This has encouraged analysts across the Street to raise the price targets of these companies.

TipRanks data shows that 67.28% of analyst calls for Utility stocks were accompanied by price target lifts. On the contrary, only 25.43% of calls were accompanied by price target cuts.

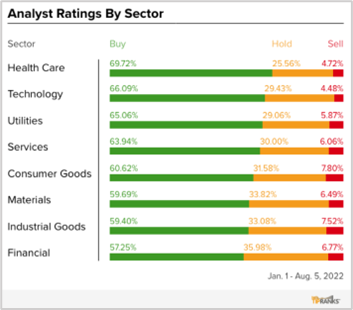

3) Buy, Hold, and Sell Ratings Per Sector

Finally, looking at the analyst ratings per sector, we see that the healthcare and technology sectors occupy the top two spots.

The healthcare sector leads with 69.72% of Buy calls and 4.72% of Sell calls. While the technology sector comes second with 66.09% of Buy calls and 4.48% of Sell calls. Healthcare stocks are inflation-proof and hence, analysts are highly optimistic about the sector in the current macro-uncertainty. Meanwhile, some companies in the technology sector can act as a good hedge against inflation.

On the contrary, the consumer goods sector has the maximum percentage of Sell ratings at 7.80%. And the financial sector has the lowest percentage of Buy ratings at 57.25%, and the highest percentage of Hold ratings at 35.98%.

Which Stock Sectors are the Winners & Losers for the Months Ahead?

A study of the above factors shows us that analysts are highly optimistic about the healthcare, utility, and technology sectors, making them the winners. On the contrary, analysts are least optimistic about the consumer goods and financial sectors, making them the loser sectors for the months ahead.