Shares of L Brands rose 2.7% after the bell on Feb. 24 as the company reported better-than-expected fourth quarter earnings. The owner of brands like Victoria’s Secret and Bath & Body Works posted 4Q adjusted earnings per share (EPS) of $3.03, beating analysts’ estimate of $2.91. Revenue for the quarter came in at $4.82 billion, up 2.4% year-on-year versus the consensus estimate of $4.87 billion.

L Brands (LB) CEO, Andrew Meslow said, “We experienced consistent strength at Bath & Body Works along with continued significant improvement in performance at Victoria’s Secret. Looking forward, we remain focused on our strategy to deliver compelling merchandise and experiences to our customers while maintaining a safe environment. At the same time, we continue to move ahead in our plans to separate our two businesses.”

Comparable store sales for Bath & Body Works were up 9% year-on-year in 4Q at $2.7 billion. However, comparable store sales for Victoria’s Secret declined 18% year-on-year to $2.1 billion.

The company expects 1Q FY21 adjusted EPS to be between $0.35 to $0.45, which represents substantial year-over-year growth as its stores were closed for most of the first quarter last year. LB expects sales growth in the first quarter to be flat year-on-year. (See L Brands stock analysis on TipRanks)

LB did not provide financial guidance for FY21 due to the continued uncertainty amid the pandemic and the impending separation of its businesses, Bath & Body Works and Victoria’s Secret, which it expects to complete by August of this year.

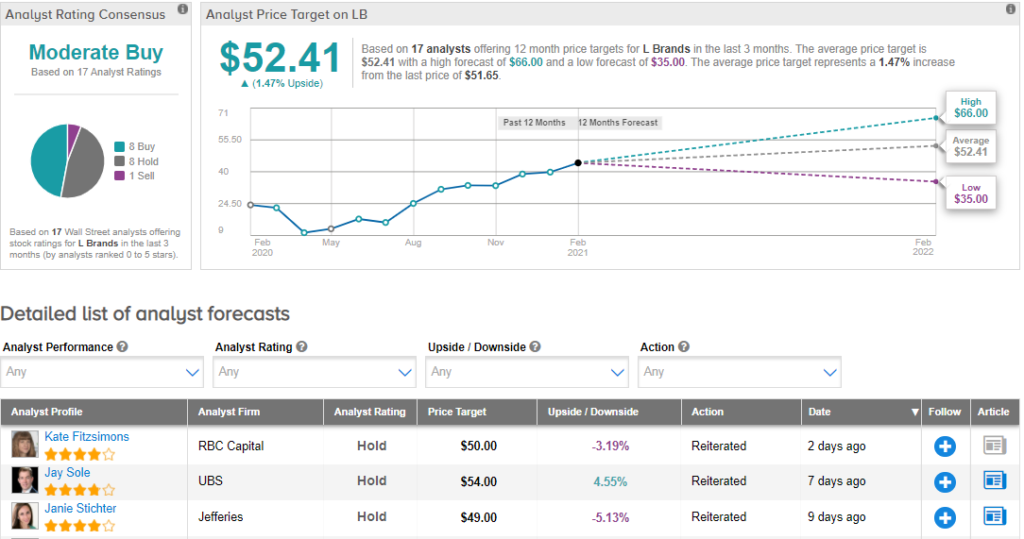

Last week, UBS analyst Jay Sole reiterated a Hold rating but raised his price target to $54 from $46. Sole expected LB’s earnings release to send its stock higher “as consensus estimates for Q1 and FY21 rise as well as to demonstrate that the Street’s long-term view for L Brands’ Victoria’s Secret brand EBIT margin outlook is too low.”

Shares of LB have gained around 14% in value over the past month.

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy consensus rating. That’s based on 8 Buys, 8 Holds, and 1 Sell. The average analyst price target of $52.41 implies upside potential of around 1.5% to current levels.

Related News:

Fisker Inks MOU With Foxconn To Develop EV; Shares Pop 22% Pre-Market

Upwork Posts Better-Than-Expected 4Q Results; Shares Pop 18.7% After-Hours

Five9 4Q Pops 10% Pre-Market On Blowout Quarter