Kraft Heinz has agreed to sell its nuts business to Hormel Foods Corp. in a cash deal valued at $3.35 billion. Kraft Heinz shares rose almost 2% in Thursday’s pre-market trading.

The deal includes most products sold under Kraft Heinz’s (KHC) Planters brand, which mainly sells single variety and mixed nuts, trail mix, Nut-ritionproducts, Cheez Balls, and Cheez Curls, as well as Corn Nuts branded products. As part of the transaction terms, Hormel Foods, the maker of Skippy peanut butter, will receive the global intellectual property rights to the Planters brand, subject to existing third-party licenses in international jurisdictions, and to the Corn Nuts brand.

The proposed sale to Hormel Foods (HRL) is expected to close in the first half of 2021, pending regulatory approval.

“This is another momentous step in our rapid transformation of Kraft Heinz,” said Kraft Heinz CEO Miguel Patricio. “It will enable us to sharpen our focus on areas with greater growth prospects and competitive advantage for our powerhouse brands. Within our Real Food Snacking platform, this means more aggressively driving real fuel for kids through Lunchables and real meal alternatives like P3.”

“As we move forward, we plan to continue deleveraging as we explore accretive investments to accelerate our strategy,” Patricio added.

The nut business contributed about $1.1 billion to the Heinz tomato ketchup maker’s net sales for fiscal year 2020, primarily driven by US sales.

As part of the agreement, Kraft Heinz will sell its Corn Nuts production facility in Fresno, California, and Planters production facilities in Fort Smith, Arkansas, and Suffolk, Virginia.

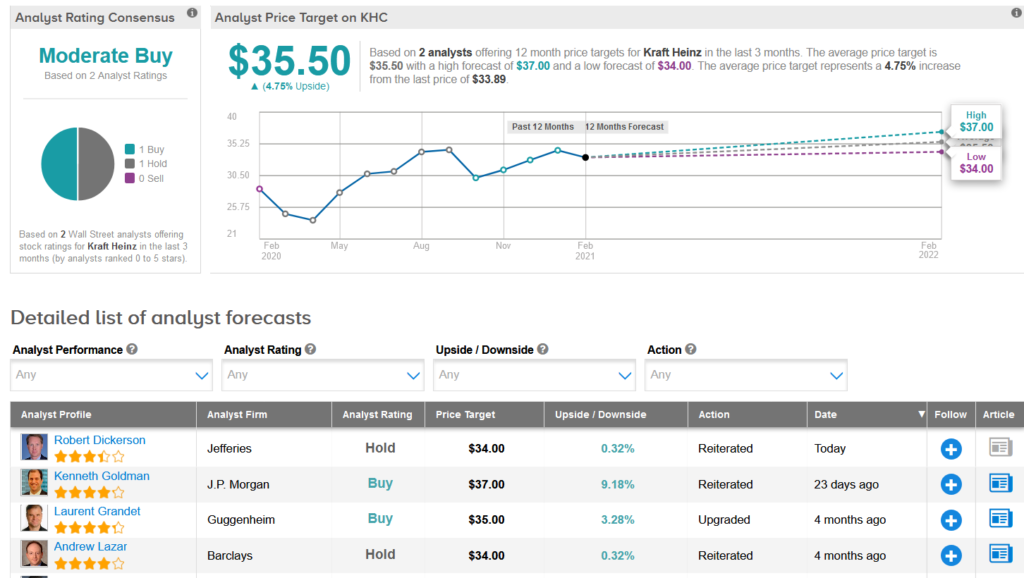

Following the Wall Street Journal report earlier this month of a possible deal to sell the nuts business for $3 billion, Jefferies analyst Robert Dickerson reiterated a Hold rating on the stock with a $34 price target.

“The divestment makes strategic sense given the brand’s 3Yr sales CAGR, contribution to KHC growth, and share trends,” Dickerson wrote in a note to investors. “Using the $3bn value, deal multiples would be ~2.2x (~$1.4bn in sales) and 12x EBITDA ($250mm EBITDA at ~18% margin), which seems fair given brand’s performance/category dynamics.” (See Kraft Heinz stock analysis on TipRanks)

Overall, analysts are cautiously optimistic when it comes to KHC stock. That’s based on a Moderate Buy consensus rating and an average analyst price target of $35.50 (4.8% upside potential).

Related News:

ARC Resources Inks C$8.1B Energy Deal To Buy Seven Generations

iRobot Spikes 9% On 4Q Profit Beat; Street Says Hold

Cisco Drops 4.6% Pre-Market On Flat Sales Growth In 2Q