Kohl’s Corporation (KSS) plunged almost 10% on May 20 despite the retail company announcing stronger-than-expected first-quarter results.

Total revenue of $3.89 billion exceeded the consensus estimate of $3.48 billion. Moreover, top-line increased 60.1% year-over-year.

Net sales in the first quarter increased 69.5% to $3.7 billion, while other revenue declined 16% to $0.2 billion.

Adjusted earnings came in at $1.05 per share compared to a net loss of $3.22 per share in the year-ago quarter. Analysts were expecting the company to report earnings of $0.04 per share.

Kohl’s CEO Michelle Gass, said, “We are positioned to capitalize on growth opportunities during the balance of 2021 and remain firmly on track to achieving our 2023 strategic goals. Based on our first quarter results, we are raising our full year 2021 guidance.” (See Kohl’s Corporation stock analysis on TipRanks).

For 2021, the company expects net sales to increase in the mid-to-high teens percentage range. Adjusted earnings per share are expected to land in the range of $3.80 to $4.20 versus previous expectations of $2.45 to $2.95.

Following the Q1 earnings release, Guggenheim analyst Robert Drbul increased the stock’s price target from $65.00 to $70.00 for a 29.3% upside potential and reiterated a Buy rating.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 7 Buys, 3 Holds, and 1 Sell. The average analyst price target of $63.40 implies 17.2% upside potential to current levels. Shares have increased 74.8% over the past six months.

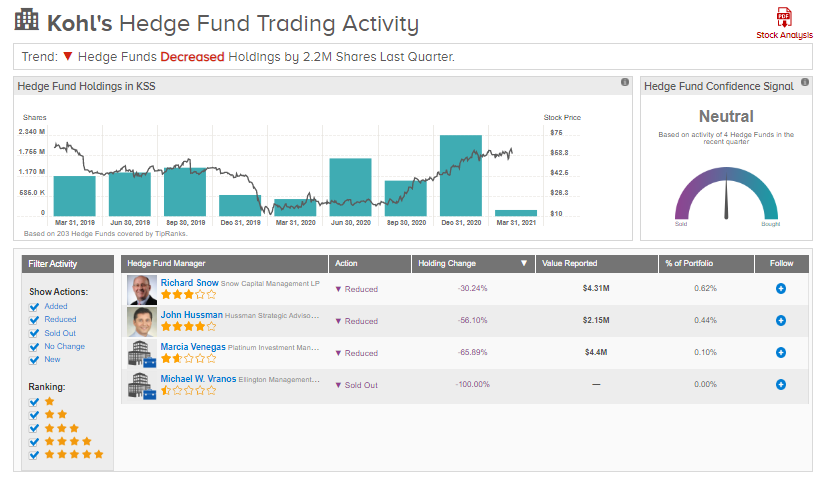

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Kohl is currently Neutral, as 4 hedge funds decreased their cumulative holdings of the stock by 2.2 million shares in the last quarter.

Related News :

Target Posts Blowout First Quarter; Shares Pop

Keysight Technologies Beats Analyst Expectations in Q2

Analog Devices Delivers Strong Q2 Results; Shares Pop 5%