Ahead of its Investor Day held on June 16, KLA Corporation (KLAC) made several positive announcements.

Based in California, KLA Corp. is a capital equipment company engaged in the supply of process control and yield management solutions for the semiconductor and related nano-electronics industries.

Increased Share Buybacks and Dividends

The company announced a new share repurchase program worth $6 billion, with plans to engage in an accelerated share repurchase of $3 billion over the next three to six months. The remaining amount will be repurchased over the next 12 to 18 months, subject to market conditions.

Notably, this is over and above the existing share repurchase authorization, which had $699 million remaining as of March 31, 2022. Further, the company hiked its quarterly dividend by 24%, to $1.30 per share.

Reaffirms Guidance

The company reaffirmed its revenue outlook for FY2022. The company continues to forecast adjusted earnings in the range of $4.93 per share to $6.03 per share, while the consensus estimate is pegged at $5.48 per share.

Revenues are forecast to be in the range of $2.3 billion to $2.55 billion, versus the consensus estimate of $2.42 billion.

CEO’s Comments

KLAC CEO, Rick Wallace, commented, “The semiconductor industry has become even more essential to an increased number of industries and geographies and is expected to grow and change in ways that benefit KLA.”

Wall Street’s Take

Following the company’s Analyst Day, Stifel Nicolaus analyst Patrick Ho reiterated a Buy rating with a price target of $505 (62.66% upside potential) on KLA Corporation.

Patrick believes that the management remains committed to returning a higher percentage of its excess cash to shareholders based on higher revenues and cash flows.

He stated, “We are supportive and believers in management’s view that the company can “sustainably outperform” wafer fab equipment industry growth and we believe that this will be displayed in strong earnings leverage, which the company has displayed for some time now.”

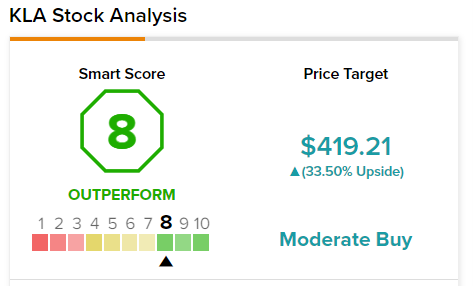

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys and four Holds. The average KLA stock forecast of $419.21 implies 35.27% upside potential to current levels.

TipRanks’ Smart Score

KLAC scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Conclusion

During the Investor Day, management provided a new 2026 target operating model that presents huge revenue and earnings growth potential.

Furthermore, the increased buybacks, dividend hike, and reaffirmed outlook speak volumes about the management’s confidence in its business strategies and long-term growth potential.