A consortium led by KKR & Co. (KKR) announced that it has purchased a minority equity stake in Vietnam real estate developer Vinhomes JSC, for a total of VND15.1 trillion ($650 million).

Shares rose 3% to $31 in midday trading. The investment will give the KKR-led consortium, which includes Singapore-based investor Temasek Holdings, a 6% equity stake in Vinhomes.

KKR said will make the investment via its Asian Fund III. The buyout fund added that the investment further underscores its strong commitment to Vietnam, where it has been active for almost a decade. The fund views Vietnam as a regional investment destination with strong development and growth prospects.

Vinhomes is a real estate developer in Vietnam active in the development, trading and leasing of residential, commercial and industrial property. The firm also provides real estate management services.

The move comes after KKR in May announced that it will inject $1.5 billion in Indian telecommunications company Jio Platforms Ltd., its biggest investment in Asia.

Shares in KKR have been on a steep recovery path soaring more than 60% since March 23 erasing all of this year’s losses.

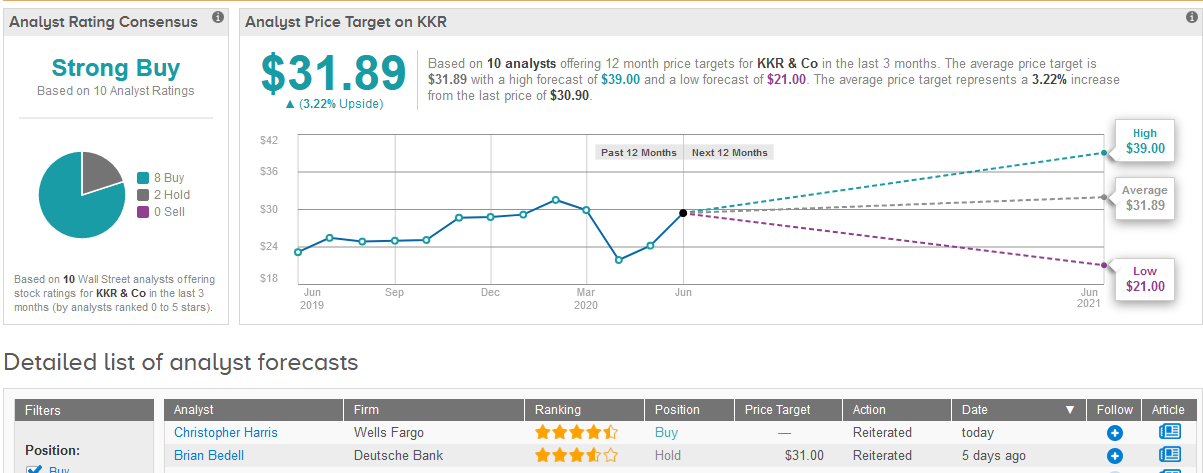

In light of the recent rally, the $31.89 average price target implies a modest 3% upside potential in the coming 12 months. (See KKR stock analysis on TipRanks).

In a bullish note, five-star analyst Chris Kotowski at Oppenheimer maintained a Buy rating on the stock with a $34 price target, saying that the private equity firm is a “very compelling investment at 9.0x enterprise value (ex net cash & investments)”.

“We think there is significant upside to distributable earnings over time as there is ample room for the real asset and public market platforms to grow, balance sheet investment to be monetized and positive outlook regarding base management fee growth on funds associated with the next-generation flagships and other associated strategies,” Kotowski wrote in a note to investors.

Turning now to the rest of Wall Street, analysts have a prevailing bullish outlook on the stock. The Strong Buy consensus boasts 8 Buy ratings versus 2 Hold ratings.

Related News:

KKR Invests $1.5 Billion in Reliance’s Jio Platforms In Biggest Deal In Asia

Google Mulling Purchase of Stake in Indian Vodafone Idea

Facebook And PayPal Invest In Indonesian App Gojek