Real estate investment trust Kimco Realty Corp. (KIM), which focuses on shopping center leasing, reported better-than-expected Q3 results, aided by a solid increase in leasing volumes, while benefiting from the Weingarten Realty Investors merger. Shares hit a new all-time high of $24.95 before closing the day up 4% at $24.34 on November 5.

Quarterly Performance

The company reported quarterly earnings of $0.91 per share, exceeding analyst estimates of $0.12 per share. In the year-ago period, KIM posted a quarterly loss of 10 cents per share.

Similarly, total revenue came in at $368.61 million, up 41.9% year-over-year and exceeding Street estimates of $272 million.

Additionally, Kimco reported Funds From Operations (FFO) of $0.32 per diluted share, including merger-related costs of 8 cents per share, with the merger being completed on August 3, 2021. The merger has increased the company’s footprint in the Sunbelt markets, adding 149 properties with 23.5 million square feet of gross leasable area (GLA).

Notably, Kimco signed 411 leases during Q3, increasing its leasing volume to 2.1 million square feet, bringing the year-to-date total to 6.7 million square feet of GLA.

Similarly, the same property Net Operating Income (NOI), excluding the Weingarten Realty portfolio, climbed 12.1% against the same quarter last year.

Happy with the quarterly results, Conor Flynn, CEO of Kimco, said, “We remain committed to ‘leasing, leasing, and leasing,’ and our success continues to validate the importance and value of the real estate we own. With the strategic addition of the Weingarten portfolio and our highly desirable open-air, last-mile grocery-anchored centers in growing markets, we are excited to again raise our outlook for 2021 as we embrace the opportunity to create additional value for shareholders.”

See Analysts’ Top Stocks on TipRanks >>

Guidance

Kimco updated its full-year fiscal 2021 guidance to include the financials of Weingarten, forecasting earnings to be in the range of $1.70-$1.72 per share, while the consensus is pegged at $0.74 per share. Similarly, FFO is projected to be between $1.36-$1.37 per share.

Analysts’ Take

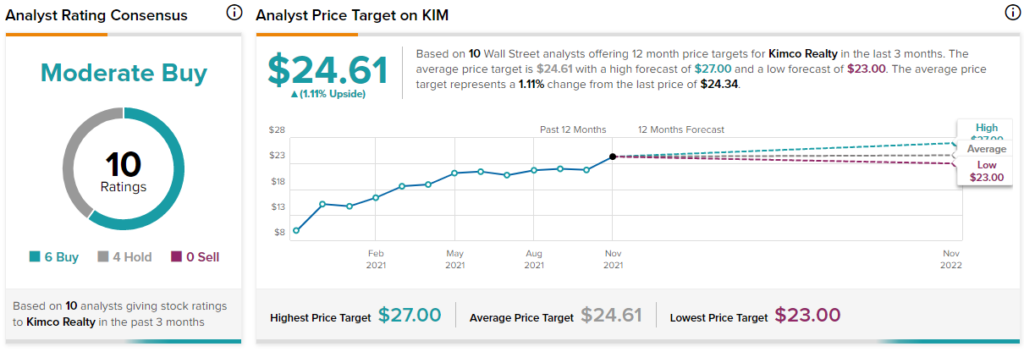

Responding to Kimco’s solid financial performance, analyst Simon Yarmak of Stifel Nicolaus lifted the price target on the stock to $25.50 (4.77% upside potential) from $22.25 while maintaining a Hold rating.

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 4 Holds. The average Kimco Realty price target of $24.61 implies 1.1% upside potential to current levels. Shares have gained 79.4% over the past year.

Related News:

DraftKings Misses Q3 Expectations; Shares Fall

Peloton Plummets on Poor Q1 Results

ViacomCBS Falls Despite Stellar Q3 Results