JPMorgan Chase & Co. CEO Jamie Dimon said on Tuesday at an investor conference that he would like to acquire asset management businesses and financial technology companies, rather than another deposit-taking institution, according to Reuters.

Dimon said that even though expenses in 2021 will likely be slightly higher than analysts’ estimates, JPMorgan (JPM) has excess capital and would like to quicken its growth by making acquisitions.

Current fourth-quarter revenues in both trading and investment banking are 20% higher than they were a year ago.

In a webcast video interview with Goldman Sachs, Dimon said, “Asset management: My line is open.”

Dimon is following in the footsteps of competitor Morgan Stanley, who recently bought the online retail brokerage E*Trade Financial, and announced that it would buy money manager Eaton Vance Corp. for around $7 billion in October. (See JPM stock analysis on TipRanks)

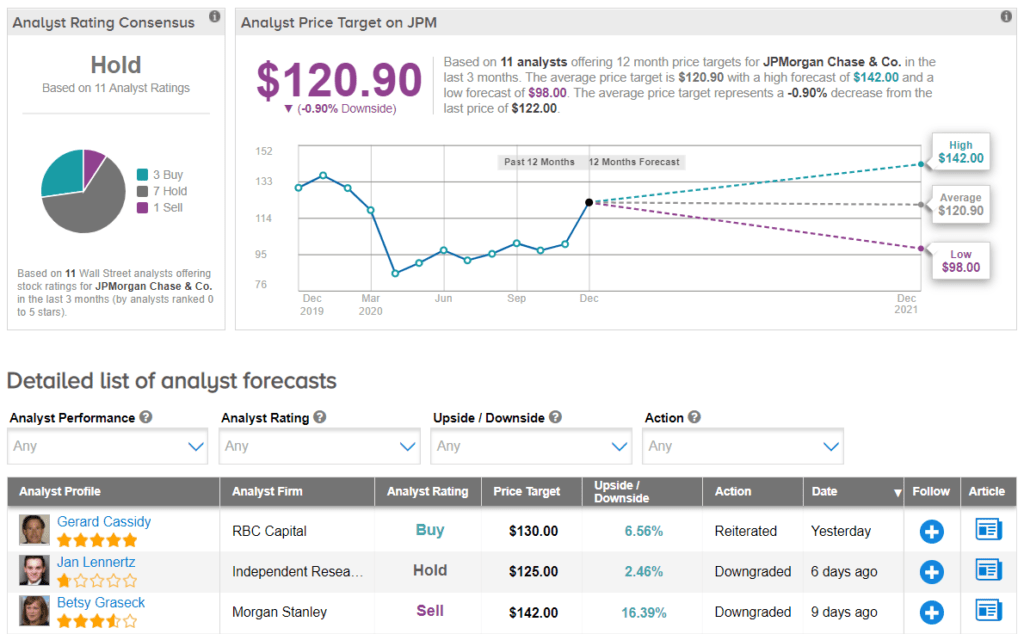

The current analyst consensus is a Hold, based on 3 Buy ratings, 7 Holds and 1 Sell. With an average price target of $120.90, shares could decline 0.9% in the year ahead.

Yesterday, analyst Gerard Cassidy, of RBC Capital, reiterated his Buy rating with a price target of $130, which suggests potential gains of 6.6% over the next 12 months.

Related News:

TJX Companies Hikes Dividend By 13%; Street Firmly Bullish

GameStop Sinks 17% As 3Q Sales Disappoint; Street Sees 54% Downside

Chewy Posts Lower-Than-Feared 3Q Loss; Stock Up 173% YTD