Top JPMorgan analyst Christopher Horvers lowered his price targets for stocks of home improvement retailers Home Depot (HD) and Lowe’s (LOW) ahead of their upcoming earnings for the fiscal third quarter. In particular, Horvers lowered the price target for HD stock to $444 from $452 and reiterated a Buy rating. Likewise, he reduced the price target for LOW stock to $275 from $283 while reaffirming a Buy rating. Let’s look at the reasons behind the top-rated analyst’s price target cuts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPMorgan Analyst Weighs in on Home Depot’s Q3 Earnings

Home Depot is scheduled to announce its Q3 results on November 18. Wall Street expects HD to report earnings per share (EPS) of $3.84 and revenue of $41.13 billion. Horvers lowered his estimate for Q3 comparable sales (same-store sales) to the low end of expectations and included the GMS acquisition in his projections. Horvers expects HD’s Q4 EPS outlook to be roughly in line with Street estimates.

Based on channel checks and recent vendor sales forecast reductions, the 5-star analyst lowered his Q3 U.S. comparable sales growth forecast for HD to 0.5% (1.0% total), which is below the Street’s expectation of 1.5% (1.6% total). Horvers highlighted that his Q3 estimates now include about a 2% sales boost from GMS. The analyst lowered his Q3 EPS estimate to $3.82, slightly lagging the Street’s consensus. The bottom-line estimate reflects higher selling, general, and administrative expenses and additional operating margin pressure related to the GMS acquisition.

Interestingly, Horvers stated that Home Depot remains his favorite pick in the home improvement space, compared to Floor & Décor Holdings (FND) and Lowe’s, which he thinks are more “remodel-driven.” Looking ahead, Horvers expects HD to deliver better comparable sales in Q4 and 2026, driven by improving replacement demand, small gains in EHS, and a bit of added inflation. The analyst noted that momentum investors are relatively bullish on Home Depot but have a negative view on Lowe’s.

Here’s What JPMorgan Expects from LOW’s Q3 Earnings

Meanwhile, based on channel checks and vendor sales outlook cuts, Horvers reduced his Q3 comparable sales growth estimate for Lowe’s to -0.4%, which is below the Street’s consensus estimate of 1.3%. Based on his lowered sales expectations and additional debt from the FBM acquisition, the analyst cut his EPS estimate to $2.95 from $3.09. That said, Horvers noted that since FBM results are reported on a one-month delay, they won’t affect Q3 results. Meanwhile, Wall Street expects Lowe’s (reporting Q3 results on November 19) to deliver EPS of $2.98 on revenue of $20.87 billion.

Horvers noted that, like Home Depot, Lowe’s witnessed weaker spending in September and October, and tougher comparisons from last year’s hurricanes and favorable weather. He highlighted that Lowe’s is generally more impacted by weather than Home Depot. Horvers further explained that when the weather is favorable, the sales gap between the two companies narrows, but when it’s unfavorable, the gap widens. This explains his contrasting expectations for Q3 comparable sales growth for HD and LOW.

The analyst expects comparable sales growth to turn positive in November as one-time weather and hurricane benefits fade. Lowe’s had guided for Q3 comparable sales growth of 1.3%, which Horvers initially saw as “reasonable,” though the post-back-to-school slowdown turned out worse than expected.

Wall Street’s Ratings for HD, LOW Stocks

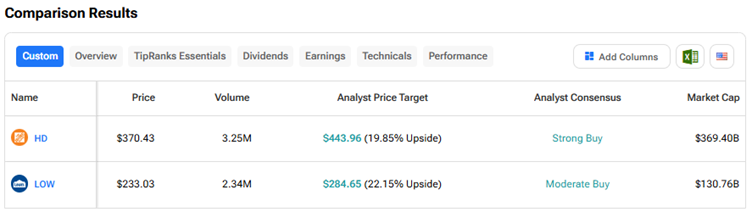

Heading into Q3 results, Wall Street has a Strong Buy consensus rating on Home Depot stock, with the average HD price target indicating about 20% upside potential from current levels. HD stock is down about 5% year to date.

Meanwhile, Wall Street is cautiously optimistic on Lowe’s stock. Shares have declined about 6% so far this year. The average LOW stock price target of $284.65 indicates 22.2% upside potential.