JPMorgan Chase & Co. (JPM) has launched a new deposit token called “JPM Coin” for its institutional clients. The move marks another step in the bank’s push into digital assets and blockchain payments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPM Coin represents U.S. dollar deposits held at JPMorgan and lets users send and receive money through a public blockchain within seconds, rather than waiting several days for traditional transfers. The service currently operates on Coinbase’s (COIN) Base blockchain, according to Naveen Mallela, global co-head of the bank’s blockchain arm, Kinexys.

The bank said the rollout followed a successful trial with Mastercard (MA), Coinbase, and B2C2. It plans to offer the service to more clients and expand to other currencies and blockchains once regulators give approval.

How Deposit Tokens Differ From Stablecoins

Deposit tokens are digital versions of bank deposits that move on blockchain networks. Unlike stablecoins, which are issued by private firms and backed by assets like bonds, deposit tokens are backed by money already held in the bank.

Mallela said deposit tokens may appeal more to large institutions because they can earn interest, which stablecoin holders do not receive. JPM Coin will also be accepted as collateral on Coinbase (COIN), adding to its usefulness for digital finance firms.

Strengthening JPMorgan’s Digital Lead

JPMorgan is moving ahead of other major banks in using blockchain for payments. Its Kinexys network already handles billions in transactions daily, and the new JPM Coin could help meet growing demand for faster, round-the-clock transfers.

With JPM Coin, JPMorgan is strengthening its lead in digital finance, showing how traditional banks are moving closer to real-time, blockchain-based payments.

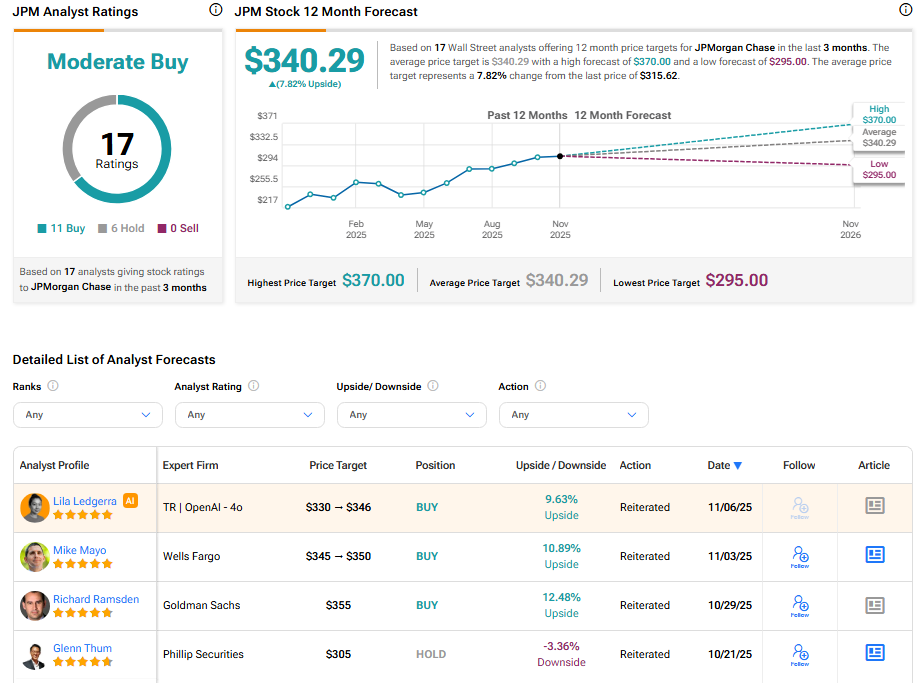

Is JPM Stock a Buy or Sell?

Currently, Wall Street has a Moderate Buy consensus rating on JPMorgan stock based on 11 Buys and six Holds. The average JPM stock price target of $340.29 indicates 7.82% upside potential from current levels.