JPMorgan downgraded Deere & Co. to Sell from Hold on Thursday ahead of the construction equipment maker’s 3Q results on August 21.

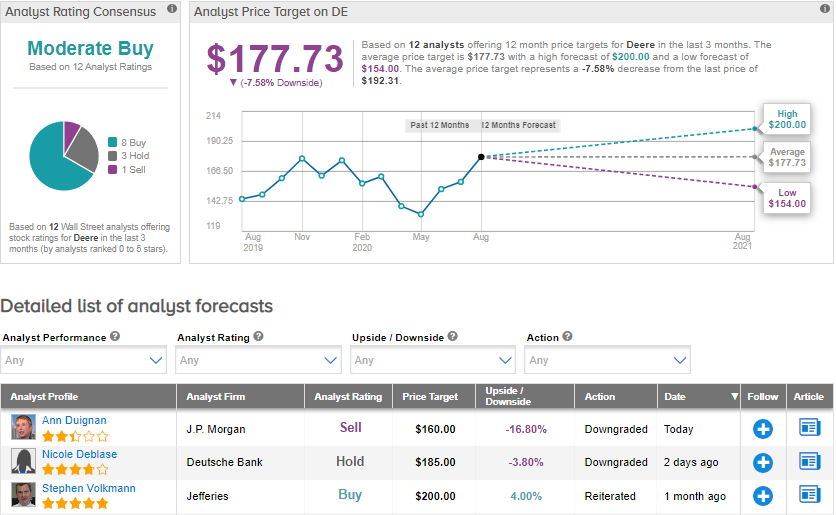

At the same time, JPMorgan analyst Ann Duignan raised the price target on Deere (DE) to $160 (16.8% downside potential) from $140. The downgrade comes after Deutsche Bank analyst Nicole Deblase on Aug. 11 cut the stock’s rating to Hold from Buy and maintained a price target of $185 (3.8% downside potential).

Deblase believes that the stock is fully priced and said that she cannot “justify a higher target multiple and/or higher earnings estimates.” The analyst sees modest downside potential to her price target.

Deere reported upbeat earnings in the last two quarters. The company’s 2Q earnings of $2.11 per share, beat the consensus estimate of $1.62 a share. 2Q revenues of $9.3 billion also topped Street estimates of $7.7 billion. However, Deere warned that full-year sales will decline this year as the COVID-19 pandemic weighs on demand for agricultural and industrial equipment.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 8 Buys, 3 Holds and 1 Sell. The average price target of $177.73 implies downside potential of about 7.6%. (See DE stock analysis on TipRanks).

Related News:

Piper Sandler Lifts NIO’s PT After ‘Solid’ 2Q Results

Deutsche Bank Cuts Micron To Hold Amid Lower Memory Pricing Bet

Gabelli Cuts Zoetis To Hold On Valuation