Starting April 5, JPMorgan Chase & Co. (NYSE: JPM) is allowing its customers to cancel their depositary receipts in Russian companies, Reuters reported citing sources.

Banks issue depositary receipts as certificates of shares in a foreign company that is listed on a local stock exchange.

The move comes a month after the London Stock Exchange (LSE) stopped trading in the depositary receipts of Russian firms, following a sharp decline in prices due to sanctions imposed on Russia by the U.S.

JPMorgan follows New York-based BNY Mellon (NYSE: BK) in restarting cancellations of depositary receipts in Russian enterprises.

Wall Street’s Take

On April 5, Piper Sandler (NYSE: PIPR) analyst Jeff Harte maintained a Buy rating on JPMorgan but reduced the price target to $165 from $187 (23.7% upside potential).

Harte has lowered the Q1 earnings estimates for the banking sector “to reflect capital markets-related revenue headwinds amid an increase in macro uncertainty and market volatility since Russia invaded Ukraine in late February.”

Overall, the stock has a Moderate Buy consensus rating based on nine Buys, six Holds and one Sell. JPM’s average price target of $172.06 implies 29% upside potential. Shares have lost 20.1% over the past six months.

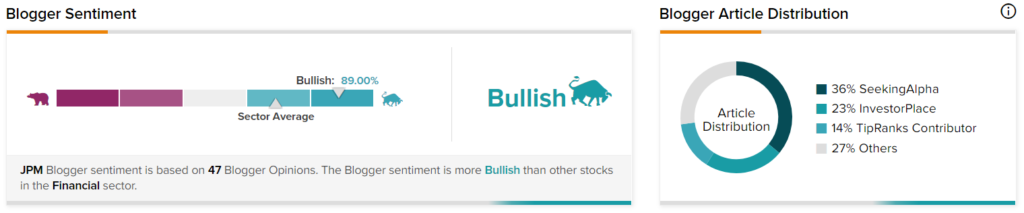

Blogger Opinions

TipRanks data shows that financial blogger opinions are 89% Bullish on JPMorgan, compared to the sector average of 69%.

Conclusion

Investors have the right to cancel their depositary receipts. However, banks banned cancellations after the Russian central bank imposed a ban on foreigners from selling shares in Russian companies. Depositary receipt issuers can restart cancellations now as the ban has been lifted. The move comes as a huge positive for investors who can liquidate their frozen holdings.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

PS Business Parks Appoints Permanent CEO

Analog Devices Showcases Top-Line Strength at Investor Day

Nio Explores Additional Revenue Stream