By all indications, Joby Aviation (NASDAQ:JOBY) made quite a splash when it advanced its electric vertical take-off and landing (eVTOL) aircraft through the Federal Aviation Administration (FAA). Despite this gain, however, Joby found itself nosediving by more than 13% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Joby turned in the complete run of its certification plans to the FAA, which completes stage three of five required to get Joby Aircraft hardware into commercial use. The third stage requires a series of reports on the designs and intended tests and analyses to come to ensure Joby Aircraft hardware works as it should. The reports in question will also help demonstrate how Joby will demonstrate compliance with safety regulations.

While this should be good news—or at least moderately so, there are two more steps in the process, and there has been some concern over Joby’s impressive run-up. Deutsche Bank, for example, notes that Joby Aircraft shares have exploded up 70% in just the last week, compared to Nasdaq’s overall 3%. Certainly, Joby has had good news, including completing a production prototype and landing some new investment from SK Telecom (NYSE:SKM), but that only goes so far. But with production ready to start in California and the U.S. Air Force itself a customer, Joby may be in a better position than some would think.

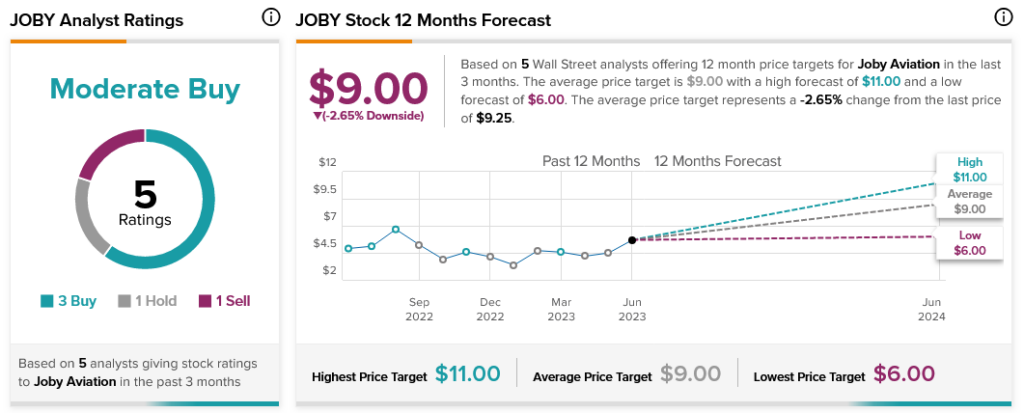

Meanwhile, analysts are somewhat split on Joby Aviation stock. With three Buy ratings, one Hold, and one Sell, Joby Aviation stock is considered a Moderate Buy. However, with an average price target of $9 per share, it also comes with 2.65% downside risk.