Jefferies Financial Group (JEF) shares gained 1.4% in Thursday’s extended trading session after the company reported better-than-expected results for the third quarter of 2021. Results were driven by outstanding growth in the Investment Banking segment, resulting from a higher number of transactions and improved pricing.

Markedly, shares of the financial services company have gained 106% over the past year. (See Jefferies stock charts on TipRanks)

Q3 adjusted earnings of $1.50 per share massively beat analysts’ expectations of $0.71 per share. The company reported earnings of $1.07 per share in the prior-year period.

Furthermore, the company reported its highest-ever Q3 revenues, which jumped 19% year-over-year to $1.65 billion and exceeded consensus estimates of $1.39 billion.

The increase in revenues reflected a whopping 100% surge in Investment Banking revenues to $1.18 billion, driven by record levels of advisory net revenues of $584 million, equity underwriting net revenues of $367 million, and debt underwriting net revenues of $229 million.

The company said that its Investment Banking backlog for the fourth quarter reached an all-time high.

However, Capital Markets net revenues declined 32.5% to $442 million, while asset management net revenues were only $10 million, down significantly from the prior-year quarter, negatively impacted by a challenging environment for multi-strategy funds and poor performance by strategies that produced strong returns during the first half of the year.

The company’s CEO Rich Handler commented, “Subject to market conditions, we believe we are well positioned for meaningful further growth, given our clear strategy, distinctively entrepreneurial and nimble culture, and the ongoing and consistent enhancements to our capabilities and talent.”

During the third quarter, the company repurchased 1.5 million shares at an average price of $34.51 per share. Markedly, the Board increased its current share buyback program by $52 million to $250 million.

Ahead of the Q3 results, Oppenheimer analyst Chris Kotowski reiterated a Buy rating on the stock with a price target of $40 (7.7% upside potential).

Kotowski believes, “It is only reasonable to expect and model that investment banking and trading will normalize to the pre-pandemic levels, and that is what we’ve been doing for all the investment banks that we follow.”

The analyst further added, “The Fed’s balance sheet is 2x what it was prepandemic, and so maybe it won’t happen, but still we’ve been building in a lot of normalization into our models.”

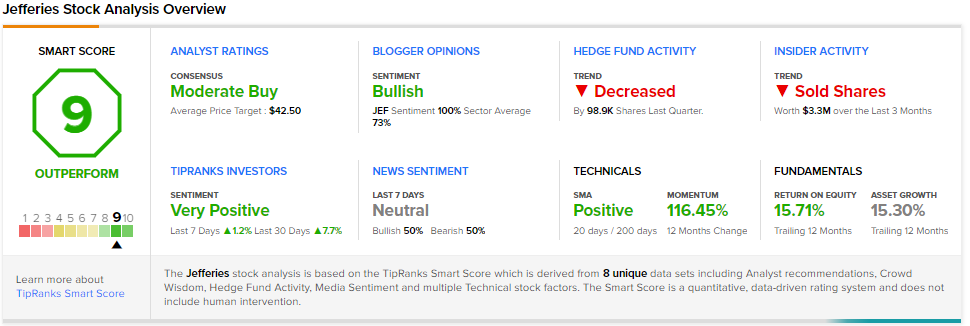

Overall, the stock has a Moderate Buy consensus rating based on 2 Buys. The average Jefferies price target of $42.50 implies 14.5% upside potential from current levels.

Jefferies scores a 9 of 10 on TipRanks’ Smart Score rating system, indicating that the stock has the potential to outperform market expectations.

Related News:

Jabil Posts Mixed Q4 Results; Shares Fall 6.1%

Uber Partners with UATP on Uber Wallet Integration

ArcBest to Snap Up MoLo Solutions for $235M