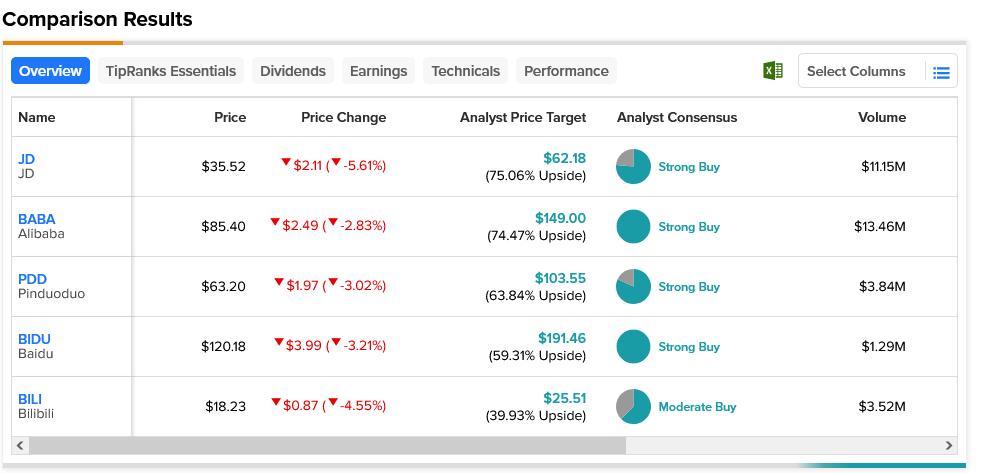

For a while, Chinese stocks—particularly Chinese tech stocks—looked like they would defy market gravity. Today’s trading—which featured JD.com (NASDAQ:JD) in full retreat—showed otherwise. JD.com led the way down, but it was hardly alone. Alibaba (NASDAQ:BABA), Pinduoduo (NASDAQ:PDD), Baidu (NASDAQ:BIDU), and even Bilibili (NASDAQ:BILI) all fell to varying degrees. JD came off the worst, but Bilibili wasn’t far behind. Conversely, Alibaba lost the least.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As for what sent JD downward, most of it revolves around the Chinese recovery from the disastrous policies of Zero-COVID. While there is a recovery in progress—and in some sectors, it’s quite good—it’s not universal. For instance, first-quarter earnings for JD came in at $0.69 per share against analyst expectations of $0.50. Revenue, meanwhile, was up just 1.4%, coming in at $35.4 billion. Therefore, the pent-up demand factor is virtually nonexistent.

JD may have been hit the hardest, but it represents the best overall package. It’s currently rated a Strong Buy, with a 75.06% upside potential, thanks to its average price target of $62.18. Meanwhile, Bilibili has the lowest upside of all five stocks at 39.93% due to an average price target of $25.51. It’s also the only Moderate Buy of the five.