JD.com announced that it is exploring options to spin off its cloud and artificial intelligence (AI) business. Shares of the Chinese online retailer closed 3.9% higher on Wednesday.

In a filing with the SEC (Securities and Exchange Commission ), JD.com (JD) announced that it is considering to spin off the assets to Jingdong Digits Technology Holding or JD Digits. The company owns a “significant minority stake” in JD Digits.

JD.com believes that if the transaction happens, “JD Digits will be better positioned to deliver a suite of cutting-edge technology services to its business partners, while the Company will continue to focus on its core competences and synergistic businesses to better serve customers.” (See JD stock analysis on TipRanks)

The e-commerce company said that the transaction is subject to the audit committee’s approval. It also cautioned that there is no assurance that the transaction would occur.

Separately, the company announced that Zhenhui Wang has resigned from the CEO post at JD Logistics on Dec. 30. The company’s board has appointed Rui Yu as the new CEO.

The latest announcement follows a report from earlier this month that the company is in talks with banks to spin off the JD Logistics business and initiate an initial public offering in Hong Kong. Earlier in a September filing with the SEC, JD.com had said that it was exploring the option to separate its JD Health subsidiary and list on the Hong Kong Stock Exchange.

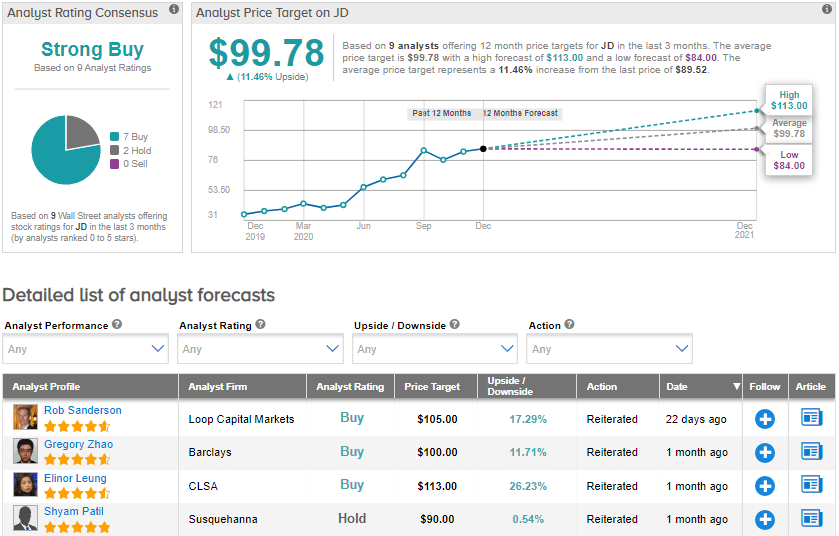

On Dec. 9, Loop Capital Markets analyst Rob Sanderson raised the stock’s price target to $105 (17.3% upside potential) from $99 and reiterated a Buy rating.

Sanderson said that the separation of JD Health and JD Logistics subsidiaries would have significant implications on the remaining e-commerce business’ earnings power and valuations.

The consensus among analysts is a Strong Buy based on 7 Buys and 2 Holds. With shares soaring over 154% year-to-date, the average price target of $99.78 implies further upside potential of about 11.5% to current levels.

Related News:

Amazon Buys Podcast Startup Wondery; Street Sees 16% Upside

Acadia To Divest Its UK Unit For $1.47B; Jefferies Lifts PT

Target To Sell Dermstore To UK’s THG For $350M; Stock Up 37% YTD