Jabil Inc. (NYSE: JBL) has reported impressive results for the second quarter of Fiscal 2022 (ended February 28, 2022). Earnings surpassed the consensus estimate by 13.5%, whereas revenues exceeded forecasts by 2%.

Better-than-expected results along with upwardly revised projections for Fiscal 2022 (ending August 2022) seem to have lifted investor sentiment for Jabil. Shares of the $8.8-billion company gained 9.7% on Wednesday, closing the trading session at $61.21.

Jabil is a manufacturing services provider with expertise in the electronics market. Formerly known as Jabil Circuit, Inc., it began operating under its current name in June 2017. It is headquartered in Saint Petersburg, FL.

Financial Highlights

Jabil’s core earnings (non-GAAP) were $1.68 per share, above the consensus estimate of $1.48. Compared with the year-ago quarter, the bottom line increased 32.3% on the back of healthy growth in revenues.

Revenues in the quarter were $7.55 billion, above the consensus estimate of $7.45 billion. Top-line growth of 10.6% year-over-year was driven by strength in segmental businesses.

During the quarter, revenues of the Diversified Manufacturing Services segment increased 4% year-over-year while those of Electronics Manufacturing Services expanded 19% from the year-ago quarter.

Cost of revenue in the quarter increased 10.9% year-over-year while gross profit increased 7% to $609 million. Selling, general, and administrative expenses of $280 million were down 8.5% year-over-year. Also, research and development expenses decreased 11.1% to $8 million. Core operating income (non-GAAP) increased 20.7% year-over-year to $344 million.

Balance Sheet & Cash Flow

Exiting the second quarter, Jabil’s cash and cash equivalents were $1,093 million, down 30.2% from $1,567 million at the end of Fiscal 2021 (ended August 31, 2021). Notes payable and long-term debt (net of current installments) was $2,380 million, down 17.3% from Fiscal 2021.

In the first half of Fiscal 2022, the company’s net cash generated from operating activities was $200 million, up 132.6% year-over-year. Capital expenditures increased 6.5% to $704 million, while adjusted free cash outflow was $74 million versus $308 million in the year-ago comparable period.

Projections

For Fiscal 2022, the company anticipates revenues to be $32.6 billion and core earnings to be $7.25 per share. The projections are above the prior expectation of $31.8 billion for revenues and $6.55 per share for core earnings.

Core operating margins are forecast to be 4.6% in the year, with free cash flow of over $700 million.

For the third quarter, the company anticipates revenues to be within the $7.9-$8.25 billion range. Core operating income (non-GAAP) is expected within the $300-$360 million range, and core earnings are expected within the $1.40-$1.80 per share range.

Official Comments

Jabil’s Chairman and CEO, Mark Mondello, said, “Our strong financial outlook is supported by both strong secular tailwinds and momentum in many of the end-markets we serve.”

Capital Deployment

During the first half of Fiscal 2022, Jabil made payments of $1.04 billion toward debt agreements. Also, it rewarded shareholders with dividend payments amounting to $25 million and share buybacks of $272 million.

Stock Ratings

Recently, Paul Coster, an analyst at J.P. Morgan, reiterated a Buy rating on Jabil while increasing the price target to $82 (33.97% upside potential) from $78.

Jabil has a Strong Buy consensus rating based on three Buys. The average Jabil price target is $83.33, suggesting 36.14% upside potential from current levels. Over the past year, shares of Jabil have gained 20.6%.

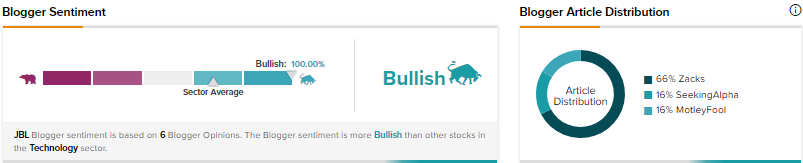

Blogger Opinions

Per TipRanks data, financial blogger opinions are 100% Bullish on JBL, compared with the sector’s average of 68%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Markforged Holding Swings to Profit in Q4; Shares Roar 13%

Smartsheet Slips 3% After-Hours Despite Lower-Than-Feared Q4 Loss

Cano Health Shares Soar 8% After-Hours Despite Q4 Miss